Tesla is lining up about $2 billion (more than 13 billion RMB) from Chinese lenders to build out its massive battery and car plant in Shanghai, according to research from JL Warren Capital.

JL Warren, a New York-based investment research firm that focuses on Chinese companies, as well as U.S. firms with significant exposure in China, wrote in a report last week that it expects backers of the Shanghai Gigafactory to include Shanghai Pudong Development Bank, Industrial and Commercial Bank of China, China Construction Bank and Agricultural Bank of China.

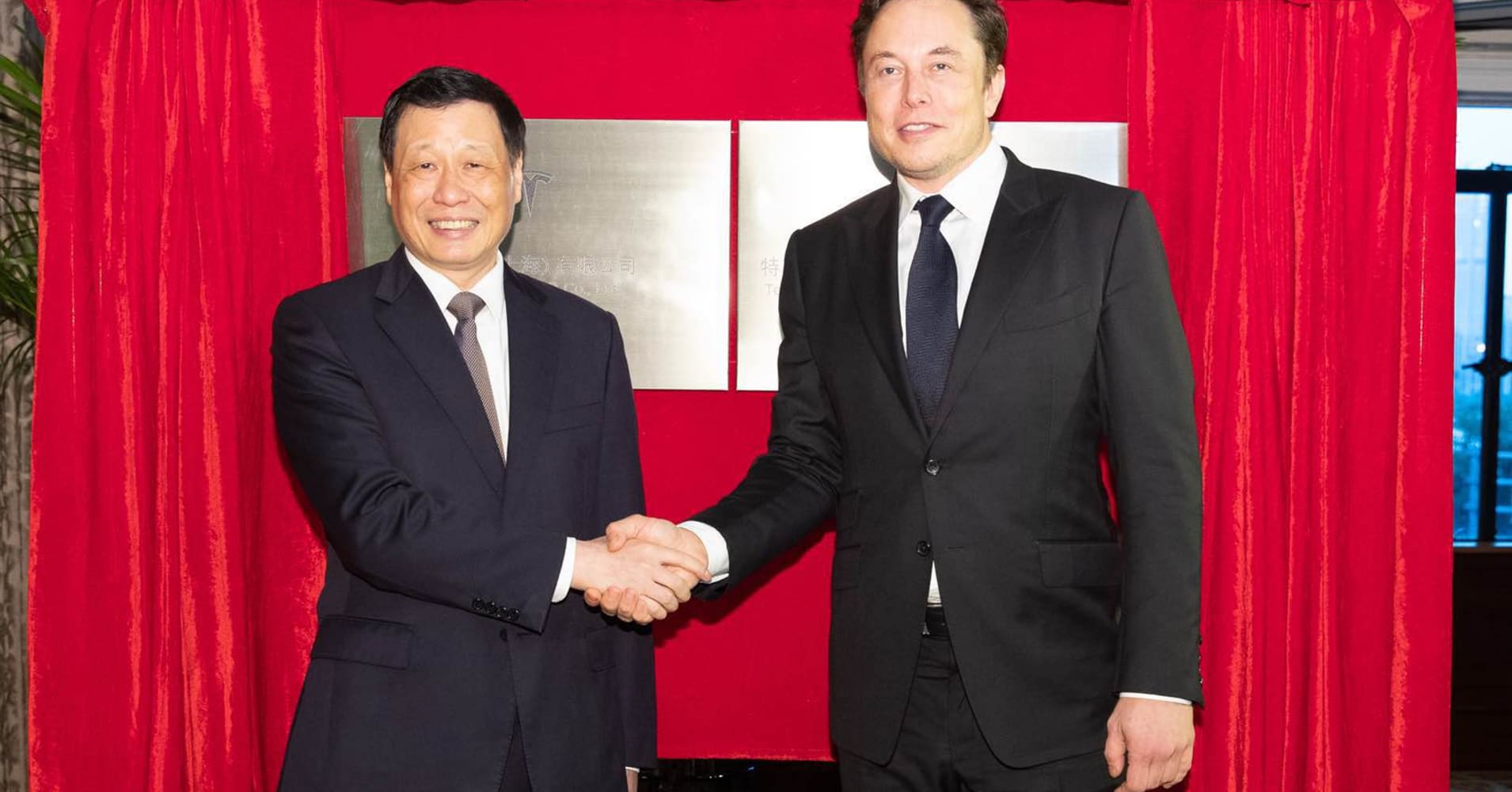

China represents a critical growth market for Tesla, and CEO Elon Musk talked up the company’s plans there on its latest earnings call in January.

“We need to bring the Shanghai factory online,” Musk said. “I think that’s the biggest variable for getting to 500,000-plus a year. Our car is just very expensive going into China. We’ve got import duties, we’ve got transport costs, we’ve got higher costs of labor here.”

According to JL Warren, which also tracks Chinese companies listed in the U.S., about $500 million (3.3 billion RMB) of Tesla’s new financing should apply to the first stage of the Shanghai Gigafactory build, with the total project loan amounting to about $2 billion.

Musk said in the fourth-quarter earnings call that Tesla would need “something in the order of $0.5 billion in CapEx to get to the 3,000 vehicle rate in Shanghai.”

JL Warren said the first stage of financing will likely have a 3.9 percent interest rate, below the Public Bank of China benchmark rate of 4.35 percent. That should help Tesla get its assembly line running to produce its initial 250,000 lower-end Model 3 electric sedans.

Tesla hasn’t reported on or confirmed details of the loans, and a company spokesperson declined to comment for this story.

Tesla has disputed JL Warren’s research in the past, such as in 2017, when the research firm reported that 6,000 Tesla cars shipped to China had not yet been sold. The company told Forbes the data was “inaccurate and not credible.”

Automakers based in China have benefited from $60 billion worth of subsidies and incentives since 2012, designed to make new energy vehicles affordable for Chinese drivers, according to ZoZo Go, an auto-tech advisory firm.

As a U.S. company without a manufacturing base in China, Tesla misses out on those benefits. Thus, a Model S that would cost around $80,000 in the U.S. today would cost around $140,000 in China after taxes.

Establishing a local factory would change that equation and allow Tesla to tap subsidies and incentives, potentially enabling the company to make and sell its Model 3 for a lower price both in China and globally.

Tesla is the only car company headquartered outside of China to be allowed to establish a factory there without a joint ownership deal with a local entity.