General Electric has spun off several businesses to generate cash and shrink its footprint but one Wall Street analyst thinks its divestitures may have gone too far.

“We caution that once GE sells off its strong cash generating businesses such as Healthcare and Rail, these assets will be gone forever,” Gordon Haskett’s John Inch said in a note to investors Wednesday.

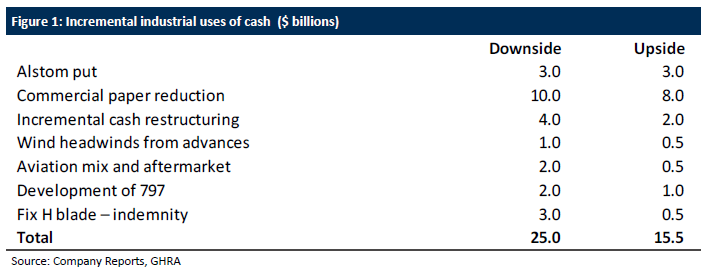

Inch took a closer look at what remains of GE, once it spins off GE Healthcare, sells its transportation business and separates from Baker Hughes. The company is trying to turn around heavy losses at the now divided power business, while focusing on the aviation and renewable businesses. Yet Inch said GE “could still end up in a precarious position,” as the company’s “outsized off-balance sheet liabilities” are “coupled with the company’s remaining weak to negative ensuing cash flow.”

GE has up to $80 billion in “total upcoming (pretax) business divestiture proceeds,” Inch said. That’s juxtaposed to GE’s remaining liabilities, which Inch said equates to between $144 billion and $203 billion.

By Inch’s math, he said the remaining GE has an equity value between negative $2.47 a share (a theoretical level below zero) and $7.11 a share, with about $2 a share at the midpoint. Here’s how Inch breaks it down:

“After adding these assumed off-balance sheet liabilities to GE Industrial and GE Capital on-book liabilities, we derive a (market) value for GE Industrial liabilities of $82bn to $98bn and a (market) value for GE Capital liabilities of $142bn to $176bn … In turn, we look at the market value of the remaining Industrial company (Aviation, Power, Renewables) and Capital company assets … [which] ranges between $71bn and $78bn (excluding assumed divestitures – see Fig 4). On the Capital side, we value the assets between $111bn and $129bn.

By subtracting asset sale proceeds from total company liabilities of $225bn to $274bn, we derive total company (post sale) liabilities of $144bn to $203bn. After then incorporating the market value of the Industrial assets ($71bn to $78n) and Capital assets ($111bn to $129bn), we impute a value for GE equity between -$2.47 to +$7.11, or just over $2/share at the midpoint.”

GE shares rose 1.9 percent in trading from Tuesday’s close of $8.66 a share. Gordon Haskett has an underperform rating and a $7 price target on GE.

The company is expected to report fourth-quarter earnings on Jan. 31.