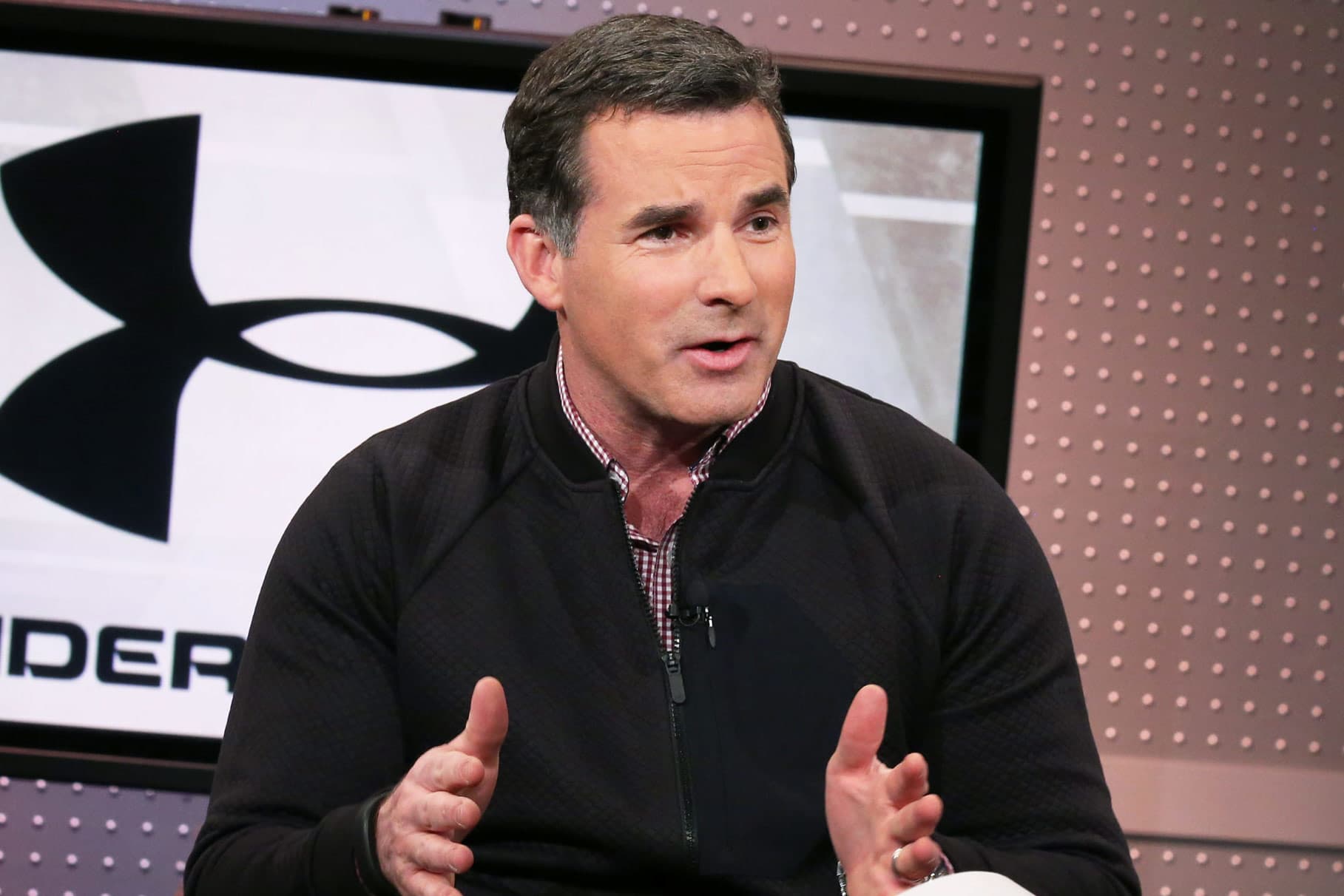

Kevin Plank, CEO, Under Armour

Under Armour on Thursday reported quarterly earnings and sales that topped analysts’ expectations.

It reported earnings of 5 cents a share for the first quarter on sales of $1.21 billion. Analysts were calling for Under Armour to break even on a per-share basis, with sales of $1.18 billion, according to Refinitiv data.

Its shares jumped more than 2% in premarket trading on the news.

Under Armour also updated its profit outlook for the full year 2019, now expecting annual earnings to fall within a range of 33 to 34 cents per share, compared with a prior range of 31 to 33 cents.

The athletic apparel and sneaker maker has been grappling with how to grow U.S. sales amid a landscape flush with competition from Adidas, Nike and Lululemon. Part of its efforts to turn things around have included cutting staff, trimming excess inventory sitting in warehouses and promising a bigger focus on new sneakers and women’s items. Some of its best-selling footwear brands of late include Project Rock, Curry 6 and the Hovr sneakers.

CEO Kevin Plank, meanwhile, has said the company plans to stay true to its “performance” gear, despite “athleisure” gaining more momentum in the U.S. Some analysts say Under Armour is struggling because the company is choosing not to pivot toward the yoga pants and casual wear trend.

Under Armour also recently lost its North American president, Jason LaRose, with COO Patrik Frisk filling the position until a replacement is found.

Under Armour shares as of Wednesday’s market close have risen about 30% so far this year.

This is a developing story. Please check back for updates.