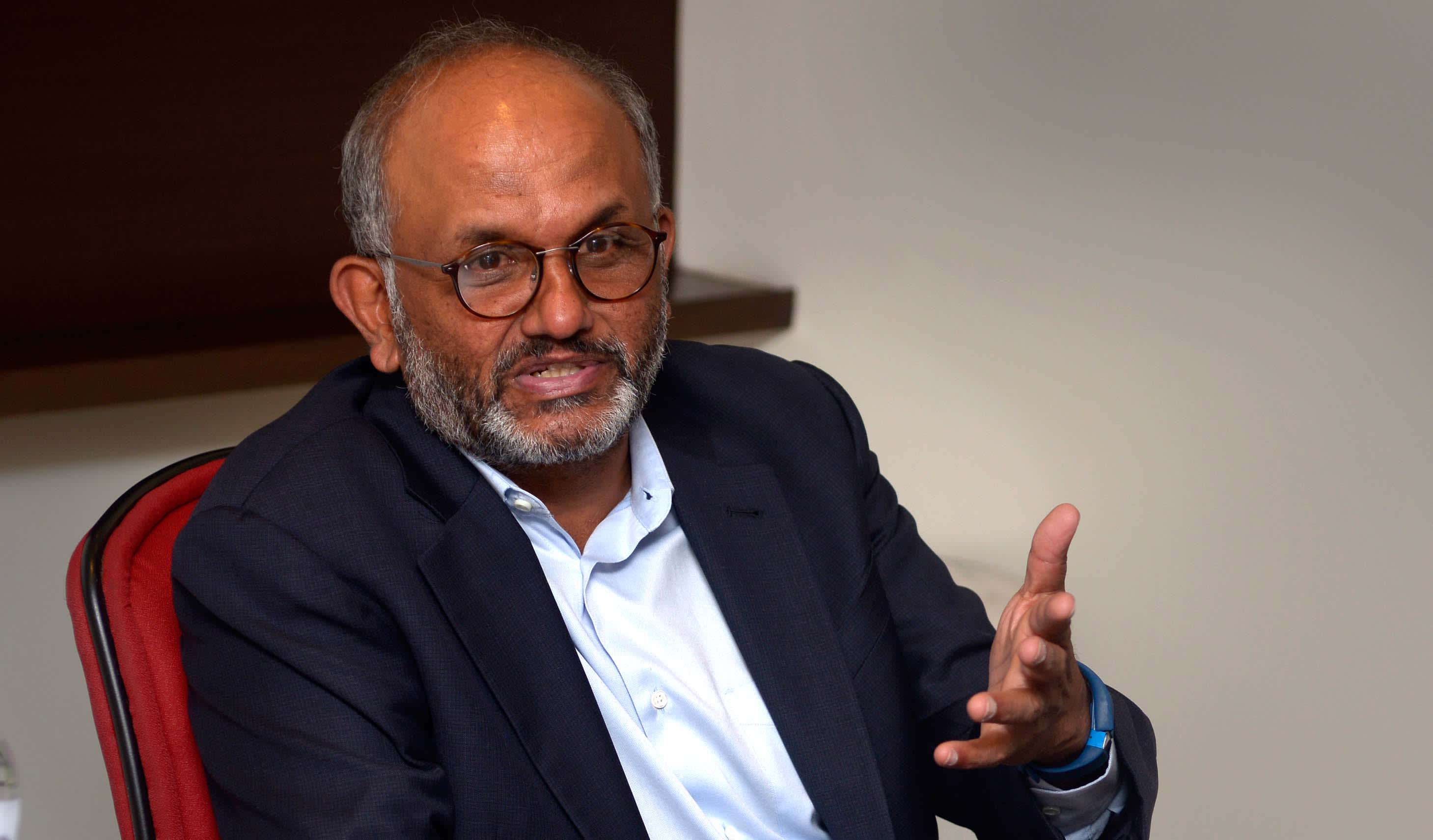

Shantanu Narayen, CEO of Adobe, attends a media event in Mumbai on May 3, 2017.

Abhijit Bhatlekar | Mint | Hindustan Times | Getty Images

Adobe shares fell as much as 4% on Tuesday after hours, as the company reported better-than-expected fiscal third quarter earnings and soft quarterly guidance.

Here’s how the company did:

- Earnings: $2.05 per share, excluding certain items, vs. $1.97 per share as expected by analysts, according to Refinitiv.

- Revenue: $2.83 billion, vs. $2.82 billion as expected by analysts, according to Refinitiv.

Guidance was soft, however. Adobe is calling for $2.25 in fiscal fourth quarter earnings per share, excluding certain items, on $2.97 billion in revenue. Adobe sees Digital Media segment revenue growing 20% from a year ago, which would be slower than the past three quarters. Analysts polled by Refinitiv had expected earnings of $2.30 per share, excluding certain items, on $3.03 billion in revenue.

In Q3, which ended Aug. 30, revenue grew 24% from the year-ago quarter according to a statement.

Revenue from Adobe’s Digital Media business, which includes Creative Cloud and Document Cloud, totaled $1.96 billion, up 22% from a year ago; analysts polled by FactSet were looking for $1.93 billion in revenue from the segment.

The Digital Experience business, which includes Adobe Experience Cloud tools for marketing, commerce and analytics, came up with $821 million in revenue. The consensus estimate from analysts polled by FactSet was slightly above that at $822.5 million.

Some bookings in the Digital Experience business were delayed in the third quarter, Adobe CEO Shantanu Narayen told analysts on a Tuesday conference call.

The delays came in the mid-market segment, and Adobe is now boosting investment in inside sales and demand generation, said John Murphy, the company’s chief financial officer.

In the quarter Adobe announced a partnership with Rite-Aid and technology previews of new technology for its Experience Cloud software.

“Our partner checks remain supportive of healthy customer demand across the Adobe product portfolio in Q3, despite early signs of global macro uncertainty and roughly half of total company revenue generated outside the U.S.,” Morgan Stanley analysts led by Keith Weiss wrote in a note distributed to clients on Monday.

Partners didn’t indicate that customers pushed back on 30% price hikes on Acrobat pricing for individuals or businesses that Adobe tested in the quarter, wrote the Morgan Stanley analysts, who have the equivalent of a buy rating on Adobe shares.

Adobe shares are up about 25% for the year.

WATCH: Cramer: Adobe is another entity that brick and mortar has to deal with