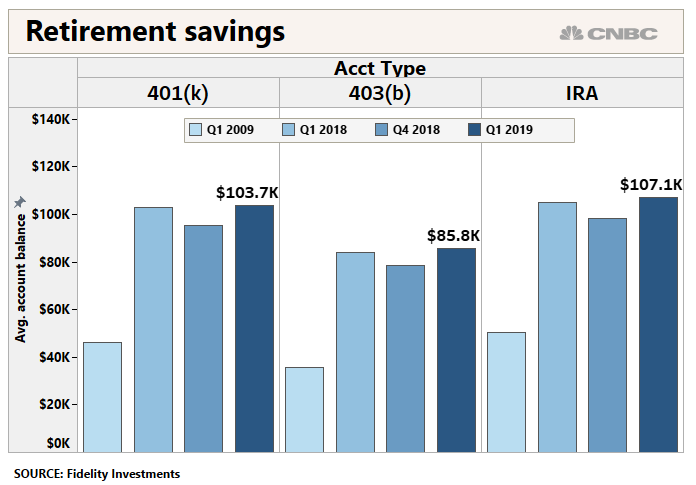

With 401(k) balances near all-time highs, retirement savers are probably feeling pretty good about themselves these days.

The first part of this year saw record contributions, thanks, in part, to a strong stock market, according to Fidelity, the nation’s largest provider of 401(k) plans.

Eventually though, savers will have to take distributions from those accounts.

And that’s when they may realize that their nest egg isn’t as flush as they previously thought.

More from Invest in You:

3 steps to determine whether you’ve earned the right to invest

Take this simple step if you want to be rich someday

Here’s what it takes to become a 401(k) millionaire

Because contributions to regular 401(k) accounts are made with pre-tax dollars, at some point they’ll have to pay the piper (in this case, the federal government and perhaps also the state they live in).

Money taken out in retirement is taxed at your ordinary income rate, which, for the top tax bracket, is currently 37% — plus state marginal rates. (If your income is lower in retirement than it was prior, you’ll likely find yourself in a lower tax bracket, but you’ll still have to pay taxes — at your new lower rate, of course — on any withdrawals from retirement savings.)

“People forget about the tax impact,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “It’s going to be a shock to them, finding out the government may be getting a third.”

To lessen the tax bite, financial pros recommend a few key tips:

For starters, as you are building a nest egg, consider a Roth 401(k) or Roth individual retirement account in addition to a traditional 401(k), said Howard Hook, a certified financial planner and CPA with wealth management firm EKS Associates in Princeton, New Jersey.

This is a better bet if you’re going to be in a higher, or the same, tax bracket down the road, he said. Contributions to a Roth are taxed up front and then withdrawals are tax-free in retirement.

One caveat: Contributions to a Roth IRA do have income limits, although the threshold is high. Alternatively, there’s no income limit on who can participate in a Roth 401(k) — and the maximum annual contribution for workers under age 50 is more than three times higher.

You can contribute $6,000 to a Roth IRA with an additional catch-up contribution of $1,000 if you’re 50 or older. Similarly, you can save up to $19,000 a year in a Roth 401(k) plus an additional $6,000 if you are over age 50.

Once you’ve reached retirement, manage distributions from all your taxable, tax-deferred and Roth accounts in a way that will keep you in the lowest tax bracket as possible, Hook said. Tap the accounts that allow tax-free withdrawals first — such as Roth accounts and brokerage accounts, which are only taxable when you sell appreciated assets to distribute cash.

It may be better to delay taking from retirement accounts and take money from more tax efficient places.

Howard Hook

“It may be better to delay taking from retirement accounts and take money from more tax-efficient places,” Hook said.

Still, the IRS requires you to start taking withdrawals out of your 401(k) or traditional IRA at age 70½. A Roth IRA is not subject to this requirement during the account owner’s lifetime.

Depending on your situation, one way to avoid the tax hit on the required minimum distribution is to give the cash directly to charity through a qualified charitable distribution, added Chris Schaefer, a senior investment advisor at MV Financial in Bethesda, Maryland.

The money you donate — up to $100,000 a year — is excluded from your taxable income.

Of course, not everybody can afford to donate their RMDs and that’s where proper preparation comes in.

Understand that what you have in your 401(k) will be taxed and plan accordingly, said Munnell. “You have to save more than you think you need.”

Check out Don’t Fall For These 5 Myths About Money via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.