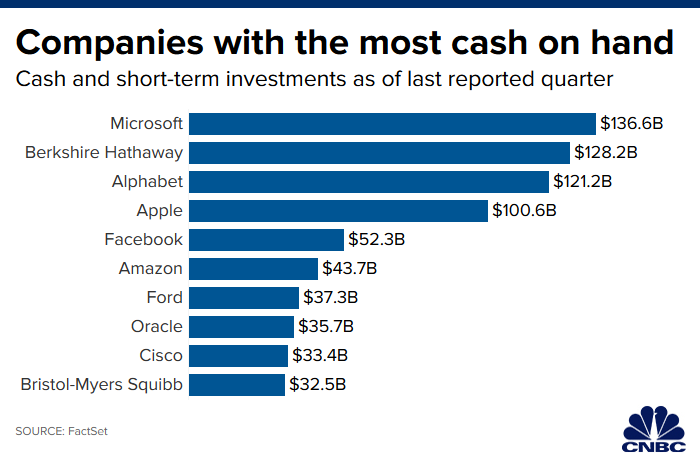

American companies are sitting on piles of cash, frustrating investors and leading some on Wall Street to wonder why they aren’t spending.

Microsoft currently has the largest cash pile at $136.6 billion as of last quarter, according to estimates from FactSet. Berkshire Hathaway, Alphabet and Apple occupy the other top spots, with $128.2 billion, $121.2 billion, and $100.6 billion, respectively.

Facebook, Amazon, Ford, Oracle, Cisco and Bristol-Myers round out the rest of the top 10 list. These figures include the company’s cash balance as well as its short-term investments such as bonds.

Companies can spend through traditional means like capital investment and acquisitions, as well as by returning money to shareholders through buybacks and dividends. Some argue that the latter — buybacks in particular — are a short-term boost for investors at the expense of the long-term health of the company and the economy more broadly.

There are many possible reasons for why companies aren’t spending more given their vast reserves, one of which is that they’re simply waiting for the right time.

“I think acquisitions are something all of these companies are thinking about as we get further along in the cycle and they look for ways to keep their top-line growth accelerating,” Nomura analyst Christopher Eberle told CNBC.

Tech companies especially like to sit on cash, Evercore’s Lee Horowitz said, to keep “dry powder as a way to weather cyclical downturns” and to take advantage of market pullbacks to pick up assets.

That’s not to say that these companies aren’t spending at all. Ford, Cisco, Bristol-Myers, Oracle, Microsoft and Apple all currently pay a dividend, and all 10 companies apart from Amazon have bought back stock this year. But some analysts say it’s not enough.

Warren Buffett’s Berkshire Hathaway on Saturday reported a $128 billion cash balance for the third quarter as well as a $700 million share repurchase program, which underwhelmed the street.

Morgan Stanley said that the buyback pales in comparison to the company’s cash balance, and that investors “may be dismayed by minimal share repurchases in the quarter.” Analysts at UBS said they were surprised “the company has not been more aggressive” with its share repurchases.

Berkshire Hathaway, which is known for buying entire companies, hasn’t done a full-scale acquisition since 2015. In his 2018 annual report Warren Buffett addressed the lack of acquisitions, saying “in recent years, the sensible course for us to follow has been clear: Many stocks have offered far more for our money than we would obtain by purchasing businesses in their entirety.”

.1573147649189.png)

Buffett may not see compelling buys right now, but other companies do. For instance, earlier this month Alphabet announced that it is acquiring Fitbit for $2.1 billion, or $7.35 per share, to grow its wearables business.

The deal is not certain to go through, however. The probes against Alphabet and other big tech companies for anti-competitive practices are ongoing, and regulators are already calling for the acquisition to be reviewed.

“This proposed transaction is a major test of antitrust enforcers’ will and ability to enforce the law and halt anti-competitive concentrations of economic power. It deserves an immediate and thorough investigation,” said Rep. David Cicilline, a democrat from Rhode Island who is one of the leaders of the antitrust probe into Google.

Given the heightened regulatory environment, Horowitz believes that while M&A activity will continue, it will be at a smaller scale. He said that big deals are going to be difficult to come by since there’s “too much headline risk.”

Pointing to Amazon as an example, whose recent purchases include Ring for $900 million and PillPack for $735 million, Horowitz said that he thinks transactions around the $1 billion mark will continue. He doesn’t anticipate acquisitions on the scale of Whole Foods, which the tech company bought for $13.7 billion in cash in 2017.

Microsoft, which at $136.6 billion has the largest cash hoard, has also been buying. Recent acquisitions include retail advertising start-up PromoteIQ, data company BlueTalon and digital advertising company Drawbridge. The company’s last major acquisition was in June of 2018 when it bought GitHub for $7.5 billion in stock. Last quarter the company also returned nearly $8 billion to shareholders through buybacks and dividends, which was a 28% increase year-over-year.

The current bull market is now the second-longest on record, stretching for 3,895 days, according to data from Bespoke Investment Group. Given the surge higher over the last ten years some view valuations as stretched, meaning now might not be the ideal time to buy.

Looking at Microsoft and Oracle specifically, RBC’s Alex Zukin said that “over the last few years both companies have been less active on the M&A front as valuations in the sector have been particularly high.”

“In terms of Oracle I would expect [them] to continue to be active on the buyback with lower likelihood for large M&A. With MSFT I would say the potential for larger M&A is higher,” he added.

Any slowdown in the high-flying growth trade could also lead to an M&A boom. “As we have seen more recently, as higher growth names pull back with the market these larger companies with cash balances will seek to acquire the highest quality names at the best price possible,” Eberle said.

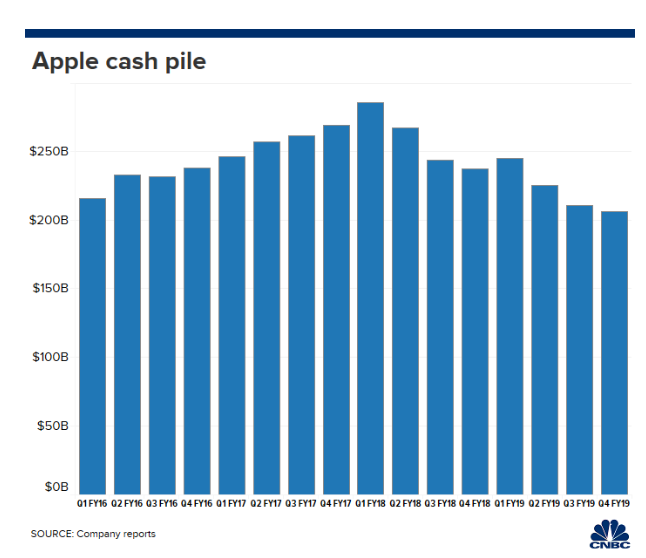

No single company has arguably faced more speculation over its cash balance than Apple. When considering short and long-term cash holdings, Apple’s balance rises to $205.9 billion. This is after the company spent $18 billion in buybacks and $2.5 billion in dividends in just the last quarter alone.

The company is working to spend down its cash. In 2018 Apple said that it was aiming to become “net cash neutral over time,” meaning that the cash on hand would balance outstanding debts for a balance of zero.

While these ten companies have a lot of cash on hand, total cash balances across U.S. companies fell last year as corporations continued to pivot cash following the 2017 tax overhaul.

Total cash balances fell to a three-year low of $1.685 trillion, according to Moody’s Investor Services which surveyed 928 non-financial US-based companies.

It’s also important to note that looking at cash balances by themselves doesn’t always tell the whole story. For instance, while Oracle has $35 billion in cash, it also has $48 billion in debt, according to Eberle, meaning the company has a net debt position.

Additionally, oftentimes a portion of a multi-national company’s cash sits outside of the United States in order to benefit from a lower tax rate.

– CNBC’s Michael Bloom and Lauren Feiner contributed reporting.