100 years old birthday cake to old woman elderly celebration funny humor

MEDITERRANEAN | E+ | Getty Images

You can never be too old for a surprise tax bill from the IRS.

Whether you’re a business owner or an individual with an elaborate estate, you may use cash value life insurance to solve any complex financial planning needs.

These contracts include a savings component, known as cash value, where money can grow free of taxes.

More from Personal Finance:

2020 could be the year everything changes for student debt

Your investments may have a partisan tilt. That may cost you

Fisher withdrawals top $3 billion as Texas pension exits

Your heirs generally get a tax-free death benefit payout if you die.

However, if you beat the insurance company by making it to 95 or 100, the insurer could cash you out and leave you owing the IRS.

“You’ve turned an income-tax-free death benefit into a tax bill, and most likely it will pay less than the death benefit, too,” said Tom Love, vice president of insurance analytics at Valmark Financial Group in Akron, Ohio.

Knowing maturity

Four senior women, varying in age and ethnicity, gathering in support of one another. One woman is teaching about a safety camera. A 101-year-old is asking a funny question.

Lucy Lambriex | DigitalVision | Getty Images

How much you pay in premiums is based on your insurance company’s mortality tables, which measure the odds of a person of a certain age dying in a given year.

So-called permanent life insurance, including cash value insurance, is meant to stay in force if you pay those premiums. This makes it different from term insurance, which may cover you for 20 or 30 years.

Permanent policies also have a maturity date that historically has kicked in around age 100. “There are a whole lot of policies that also have maturities around age 95,” said Love. “So this can be a bigger issue.”

That means when you turn 100, your insurance company will pay you the cash value of your policy and end the contract.

Not only might this amount be less than the death benefit your heirs would have otherwise received, but you might also be taxed on the amount that exceeds the premiums you’ve paid.

To make things worse, if you have large loan against your policy at age 100, your debt will be forgiven, but you’ll still be on the hook for taxes for the cash value and the amount borrowed.

“Worst result is that you have no cash, but you still owe the tax,” said Barry D. Flagg, a certified financial planner and founder of Veralytic, a Tampa, Florida, publisher of life insurance pricing and research. “In both cases, you lose your life insurance.

Living longer

Many policies that were issued before 2004 mature at 100, said Michael Lovendusky, vice president and associate general counsel of the American Council of Life Insurers.

“At the time when these tables were established, it was something that the industry didn’t think about,” said Love.

“The odds of people living to 100 were insignificant from an actuarial perspective,” he said.

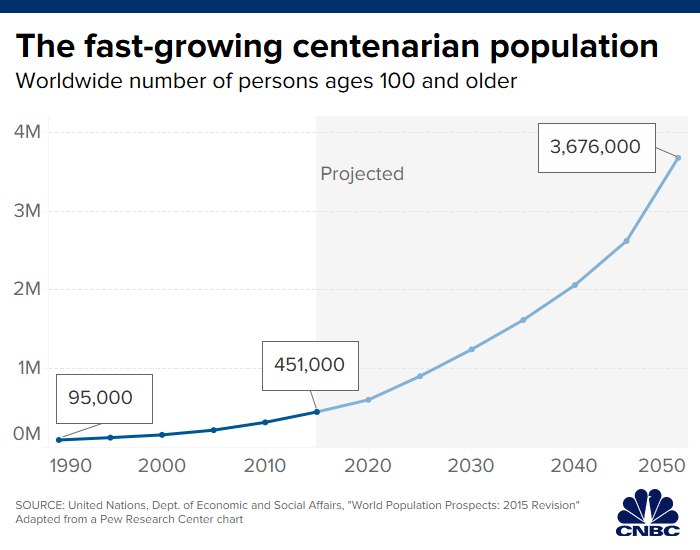

Globally, there were close to half a million individuals over age 100 in 2015, according to the Pew Research Center. That number is expected to grow to nearly 3.7 million by 2050.

To contend with the growing number of centenarians, in 2004 state insurance commissioners adopted an updated mortality table that has pushed out the maturity date of new policies to age 121.

This means you can keep your coverage intact well beyond your 100th birthday if you have one of these newer policies.

Planning for longevity

Ralph Orlowski | Getty Images News | Getty Images

If you’re in your 60s or 70s, it just might be time to talk to your financial advisor about what might happen as your 100th birthday approaches.

Here are two potential options:

- Changing your contract: If you’re young and insurable enough, ask your advisor whether it would make sense to switch to a new contract with a maturity date of 121.

- Maturity extension rider: Some contracts come with a rider or an endorsement that can push out the maturity date past 100 without having to trade in the contract.

“The sooner you address it the more viable options you will have,” said Love. “The longer you wait, you might not be able to get a different policy if you’re too old.”