Erica Yungen Ostergren, 51, admits to a very casual password system: an old school catalogue envelope with cross-outs and coffee rings.

Source: Erica Yungen Ostergren

Erica Yungen Ostergren keeps important financial information, such as website passwords and logins, in one handy place.

“Hilariously, it is all on the back of a yellow envelope that I have been stashing in a drawer for six years, scribbling out and updating as needed,” said Ostergren, a 51-year-old counselor in private practice in Salem, Oregon.

Few people relish the idea of assembling all their financial info in one easy-to-find place, often in what’s called an “ICE binder” (as in “in case of emergency”).

First, it’s no fun contemplating disastrous life events. Second, it seems like an impossible task with many parts. So many pieces, and so many different websites, log-ins and account numbers.

The sheer number of accounts from past jobs is one reason Sharon Payne Rick, 43, a physician recruiter in San Rafael, California, keeps putting off this task.

The biggest issue, Rick says, is information overload. Two choices would be much easier, but the flood of information from podcasts, websites and apps makes it hard to decide.

More from Invest in You:

Here’s how to invest like Warren Buffett

Indianapolis is tops for great museums and a fantastic church sale

What almost no one knows about emergency savings

You don’t know where to start

Ken Hoyt, a certified financial planner with Perennial Advisors in Westford, Massachusetts, says a good first step is to simply make a list of the types of accounts you have, grouped by type of institution: banks, investment accounts, retirement accounts, life insurance accounts.

For each, you’ll want to write down the name of the bank or company, your account number, user name and password. “Try to take a small bite, and you’ll do more than you expected.”

Your goal could be getting your banks in one place on a spreadsheet. “Next day, add the investment accounts,” Hoyt said.

Make sure to work out a method to let your loved ones know where you’re storing the information, Hoyt says.

Try an Excel file …

Many people in Hoyt’s office have the same method, an Excel spreadsheet that is locked with a password. (Don’t name the file “Passwords,” Hoyt warns.)

He prefers the desktop version of Excel, not the cloud-based Google doc. “There’s always a chance you can give up your machine to someone,” he said.

Even with a file stored on your computer, you still need a second step, says Bryan Kirk, director of financial and estate planning at Fiduciary Trust Company International in San Mateo, California.

You must specify how someone else can access it. It’s not enough to have everything in a safe deposit box; someone has to be able to find the key or the password to get in.

Have a paper equivalent for information stored digitally. “Think about digital obsolescence,” Kirk said. “I have T-shirts from the ’90s, books from the ’60s.”

When it comes to technology, he says, nothing in his house is more than 5 years old. “Using a brand-new account management tool can be helpful for us day to day but may not be that helpful 15 or 20 years from now.”

In other words, you may not want to store your valuable financial data on the Myspace of password managers.

… or an old-fashioned notebook

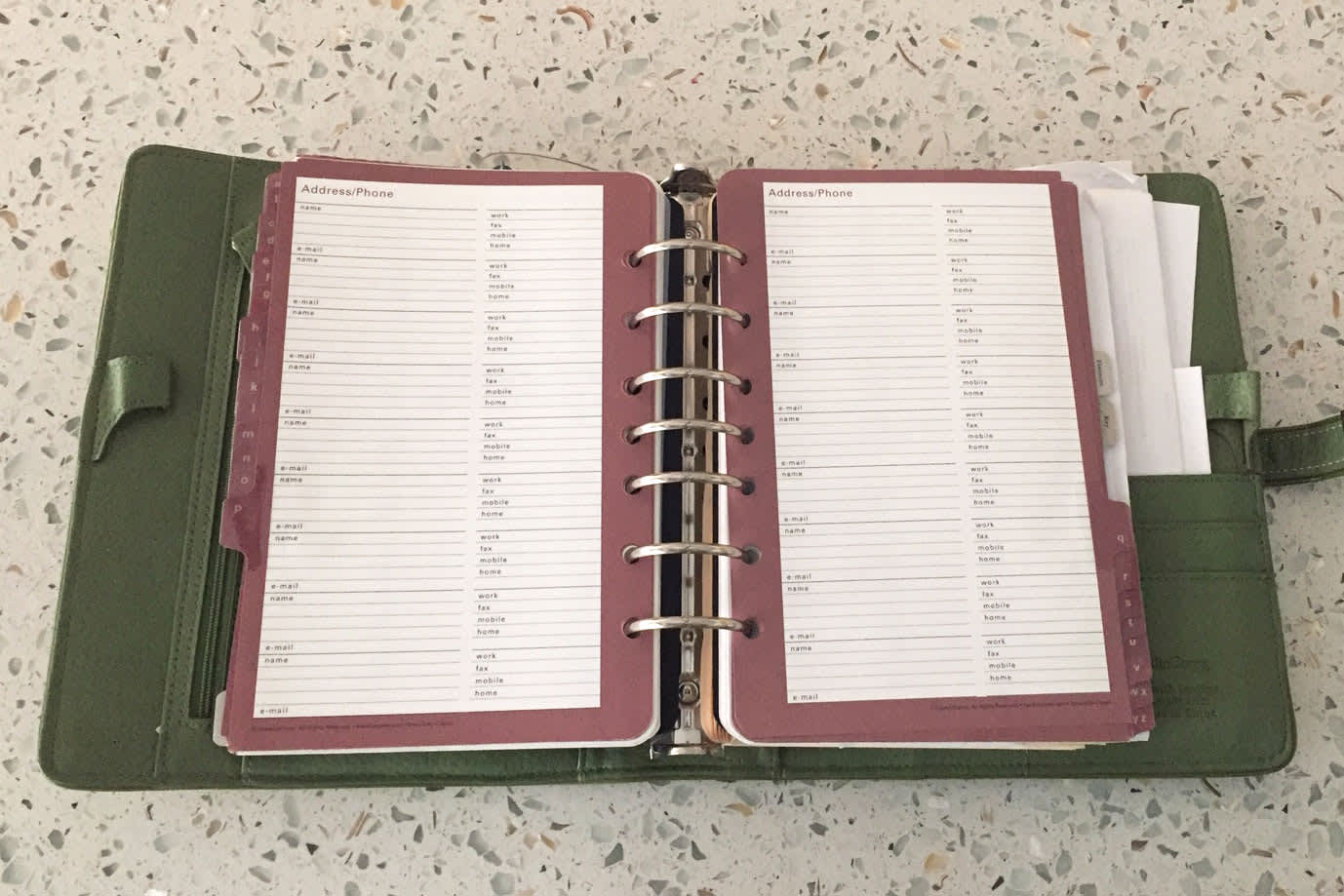

Christina Barnes uses a Day-Timer to keep track of passwords and logins for financial accounts.

Source: Christina Barnes

Christina Barnes-Parker, 44, of Venice, Florida, crosses out old passwords when they need updating in a Day-Timer. “I told my husband no thief would steal that old thing from the house,” she said.

Hoyt said he also likes a 1-inch binder that can easily be edited and rearranged.

Ostergren started her envelope about six years ago. “The reason I’ve kept it so long is, the envelope is yellow, so I can find it easily,” she said. “It’s covered in coffee rings. It has the financial accounts, our bill-paying accounts, my Yahoo and Google passwords.”

It may seem like an on-the-fly arrangement, but it works for her family. “My husband would know where to find this,” Ostergren said. “I’m the one who pays all the bills.

“If someone needed to know anything, from the HBO Go password all the way to the Schwab account, they’re all there.”

In your ICE binder, have an index card that says where you keep any important information on your computer (what drive, what the file name is). Since the Excel file should be password-protected, you’ll also want to indicate that password. You might consider using a code, such as your third cousin’s middle name or place where you and your spouse had the first date.

Consider an easy tech solution

People who praise password manager software bring up three points.

You don’t have to remember all those passwords. For a fairly low cost — a monthly $3 for one user — a password manager app stores your passwords securely. You can share passwords with other users (family members or a trusted friend) for a small extra monthly fee.

The app 1Password seems to be universally loved. Other password managers include LastPass, the open source KeePass and Keeper.

For extra security, you might want to enable two-factor authentication, even if some evidence is starting to surface that says it’s not 100% foolproof.

How long will this take?

Hoyt estimates that the average person has about 15 accounts, not including shopping sites such as Amazon. The total time to sit down and consolidate all your information for these accounts?

“Maybe two hours total,” Hoyt said. “That’s the maximum.

“It’s really not that long — it’s just sitting down and getting started,” he added. “Like with most things, that’s always the hardest part.”