Dow Inc. beat Wall Street estimates for profit in the third quarter as it cut costs to offset a sharp slowdown in demand for the chemicals it makes for plastics and other manufacturing, sending shares almost 2% higher.

An oversupply of ethylene and polyethylene as well as the impact of U.S.-China trade tensions on demand for chemicals forced Dow in July to forecast lower-than-expected third-quarter revenue and cut its targets for full-year spending.

The company, which makes chemicals used in paints, cosmetics, and plastics, said it had now saved about $1.37 billion as part of a previously-announced cost reduction program and had cut an additional $40 million in expenses in the latest quarter.

Its main indicator of operating profit fell 32% to 91 cents per share but that was still 18 cents per share better than consensus forecasts.

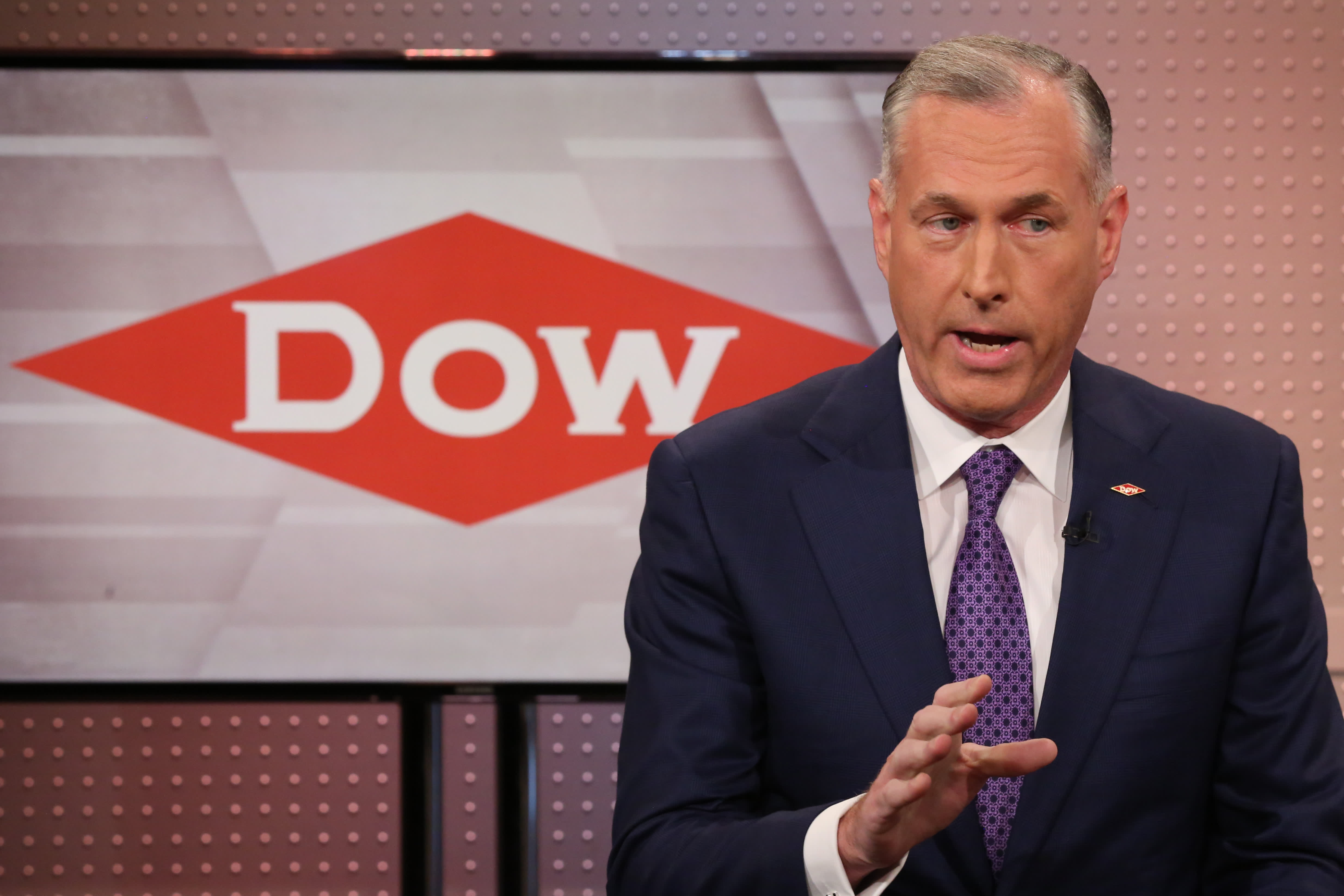

Jim Fitterling, CEO of Dow Chemical

Adam Jeffery | CNBC

Like larger German rival BASF, which reported a 24% drop in operating income earlier on Thursday, Dow is wrestling with a sharp slowdown in global demand, with the biggest falls coming in its North America and its Europe, Africa and India business.

It said sales volumes fell 2% in the third quarter, while prices declined 12%. Sales in EMEAI and the U.S. and Canada were down respectively 17.5% and 15.6%, while those in Asia-Pacific fell just 7.5%.

“Dow delivered a strong third quarter driven by higher than expected plastics margins,” said Jim Sheehan, an analyst at brokerage SunTrust Robinson Humphrey.

“Amid deteriorating business fundamentals heading into the fourth quarter, management is focused on rationalizing capital expenditures, leveraging feedstock flexibility and working down stranded costs.”

The attack in mid-September on Saudi oil major Aramco and outages in the United States are expected to boost prices for chemicals globally, but additional capacity from China and Korea, as well as the fall-off in demand, are dampening the impact.

Dow said it had taken measures to boost prices and that those for polyethylene had risen in September.

Sister companies DuPont, which makes chemicals used in the automotive and electronic industries, and Corteva, which makes pesticides and insecticides, are set to post their quarterly reports on Oct 31.

Net sales fell 15.2% to $10.76 billion, marginally beating analysts’ estimate of $10.74 billion, according to Refinitiv IBES.

Through Wednesday’s close, Dow shares had fallen nearly 15% since they started trading following the company’s split from DowDuPont on April 2. They gained 1.6% to $48 per share in initial premarket trading on Thursday.