A financial advisory firm has been charged by the Securities and Exchange Commission with defrauding former professional football players.

Former principals of Cambridge Capital Group Advisors, Philip Timothy Howard and Don Warner Reinhard, allegedly took more than $4 million from around 20 retired NFL players to invest in private hedge funds managed by the Tallahassee, Florida-based firm from October 2015 to March 2017.

More than 20% of the players’ funds were allegedly misused by the partners, the SEC said Thursday. Howard allegedly used some of the funds to cover the cost of his personal residential mortgages.

The former players first landed in the offices of Howard and Reinhard in the hopes of joining the class-action lawsuit against the National Football League over concussion-related brain injuries. Some of the men have serious illnesses.

It was during this work when the partners convinced the men to invest in their private funds.

More from Personal Finance:

These 20 states and cities have the cleanest hotels

Owe back taxes? You might lose your passport

The foreign trips that Americans insure the most

To do so, half of the players transferred their NFL 401(k) savings accounts over to the firm. One former player — Larry Webster, told Law 360 that Howard and Reinhard promised him they would double his retirement saving’s returns.

James Sallah, an attorney for Cambridge Capital Group Advisors, did not immediately respond to a request for comment. Reinhard is serving a prison sentence after being found guilty in 2017 of aggravated child assault.

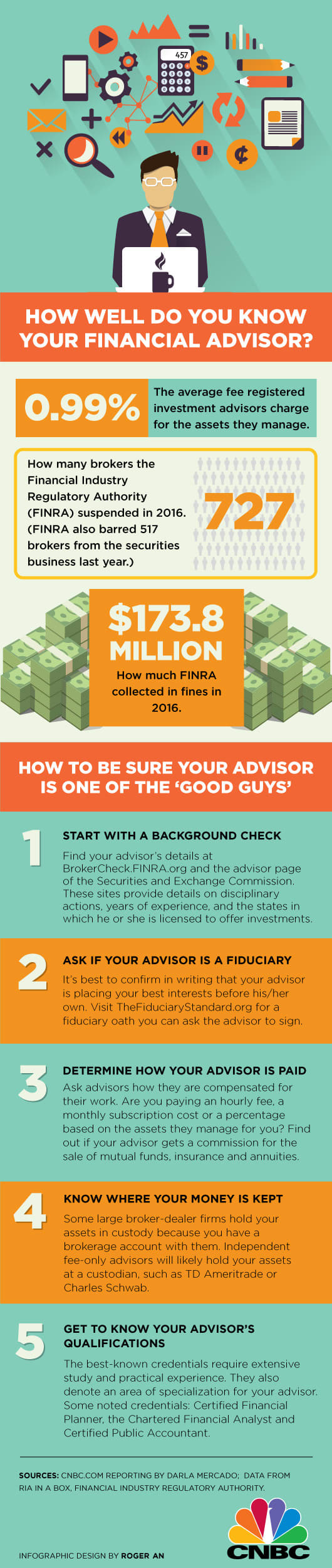

The case serves as a good reminder of how important it is to vet your advisor. Reinhard had been barred by the SEC from working in the securities industry.

The NFL Players Association offers players access to financial professionals who sign up for its Financial Advisors Registration Program.

Participating advisors must pay a $2,500 fee, have a minimum of eight years of licensed experience and must be a certified financial planner or a chartered financial analyst.

Still, people should take the time to review an advisor on the Financial Industry Regulatory Authority’s BrokerCheck website and the Securities and Exchange Commission’s investment advisor search site.

Players should also make sure advisors hold clients’ assets at a custodian.

“The advantage of keeping money at a custodian is that the custodian sends monthly statements to the client,” said Robert Pagliarini, a CFP and president of Pacifica Wealth Advisors in Irvine, California.

Athletes must also make sure that their advisors, accountants and attorneys are all serving in their best interest.

“Only hire accredited fiduciaries,” said Jordan Waxman, a certified financial planner and managing partner at HSW Advisors in New York. “Have a team of them.”

— CNBC’s Darla Mercado contributed to this report.