Jeffrey Epstein was worth an estimated $559 million, yet may have paid little in the way of personal income taxes.

The now-deceased financier, accused of sexually assaulting and trafficking girls as young as 14, had more than $179 million in assets from real estate, including a New Mexico ranch, a home in Palm Beach, a residence in Paris and a private island in the U.S. Virgin Islands — Little St. James.

The Virgin Islands has its own system based on the tax laws and rates that apply in the U.S., according to the IRS, yet some tax-incentive programs there also make it possible for residents to reduce their federal income tax liability by as much as 90%.

“Epstein, if he didn’t spend more than 183 days in the U.S., could take advantage of being a resident in the Virgin Islands and possibly reduced his tax liability,” said Timothy Speiss, a CPA and partner in the personal wealth advisors practice of EisnerAmper LLP.

Claiming residency in a low- or no-tax jurisdiction typically means spending 183 days a year there, for starters, and, according to reports, Epstein changed his residence to his Virgin Islands estate nearly a decade ago.

Little St. James Island, one of the properties of financier Jeffrey Epstein, is seen in an aerial view near Charlotte Amalie, St. Thomas, U.S. Virgin Islands July 21, 2019.

Marco Bello | Reuters

If there’s one thing rich people like, it’s saving on taxes.

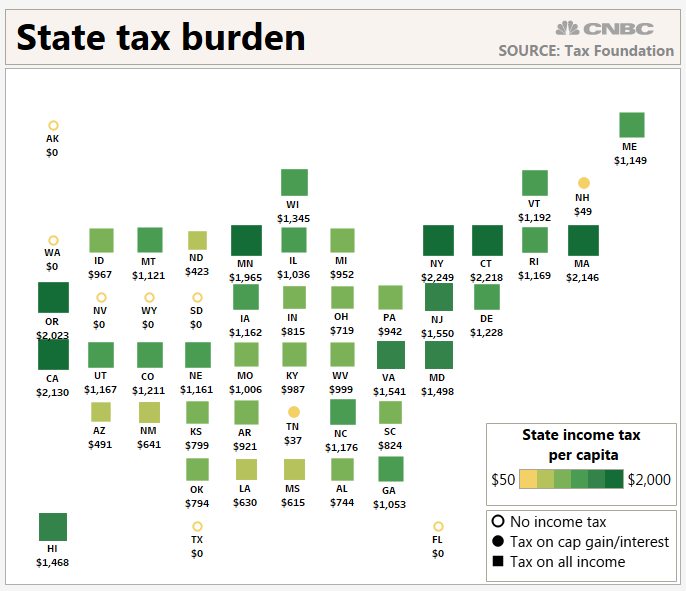

More often, high-income residents in high-tax states such as New York and New Jersey consider moving to an income tax-free haven such as Florida for just that reason.

Similarly, it takes six months and one day to establish residency in Florida, where there are also zero taxes on Social Security and retirement income. Meanwhile, New Yorkers are paying some of the heftiest state income taxes nationwide. Consider that the top income tax rate in New York is 8.82% and combined New York City and state taxes are about 12.7%.

Over the last decade, the Sunshine State has been the most desirable destination by far for older Americans, as measured by average annual net migration for the 55-plus set, according to an analysis of Census Bureau data by William Frey, a demographer at the Brookings Institution.

Tack on the new $10,000 cap on the state and local tax deduction on federal taxes, a feature of the Tax Cuts and Jobs Act, and it becomes only more attractive.

For those at the very high end of the income spectrum, the tax savings can be in the millions, according to Mike Savage, a certified public accountant and chief executive officer of 1-800Accountant, which offers financial services to small business owners.

However, New York is getting more aggressive about going after people it considers taxpaying residents, so skirting that tax bill is no easy feat. For one thing, income taxes make a significant contribution to states’ coffers. Nearly 40% of state tax collections come from levies on wages, according to the Tax Foundation.

More from Personal Finance:

Five reasons why your high-tax state won’t let you move out

Retirees are flocking to these ‘hot’ spots

4 tips to prepare your finances for retirement abroad

New York conducted about 3,000 “nonresidency” audits a year between 2010 and 2017, collecting around $1 billion, according to Monaeo, a company that sells an app for tracking and proving tax residency.

To that end, state tax agents will look at all available records such as credit card charges, utility bills, property taxes, DMV records, voter registration, doctors visits and more.

The onus is on the taxpayer to account for their whereabouts outside of New York, Savage said. “It’s guilty until proven innocent.”

“You literally have to be outside of New York State for 183 days and prove it by taking a picture of yourself with a newspaper every day.”

In fact, states generally have two tests to determine your domicile, according to David Cherill, a member of the American Institute of CPAs’ personal financial planning executive committee.

The first is an objective test, which is the number of days spent in one location. The second is a subjective test, which is how the facts line up: “Where is your daily life?” Cherill said. “If you have a golf club in the Hamptons, that says you are there a lot in the summer.”

For those that want to legitimately relocate to Florida, or any tax-preferred state, Cherill advises clients to plan the move at least a year in advance.

“The first thing is to come up with a proactive plan, map this out,” Cherill said. “Assess what you are willing to part with in the high-tax state,” he said — you don’t have to sell your home in your original home state but it helps to show you’ve made a commitment to leave. “Then keep records of where you are that line up with your credit card statement.”

Also, systematically change everything over, from your driver’s license to your doctor, to reflect your new residence, he said.

Beautiful swimming pool in Florida.

TerryJ | Getty Images