Getty Images

The wealth gap between baby boomers and millennials has become a gulf.

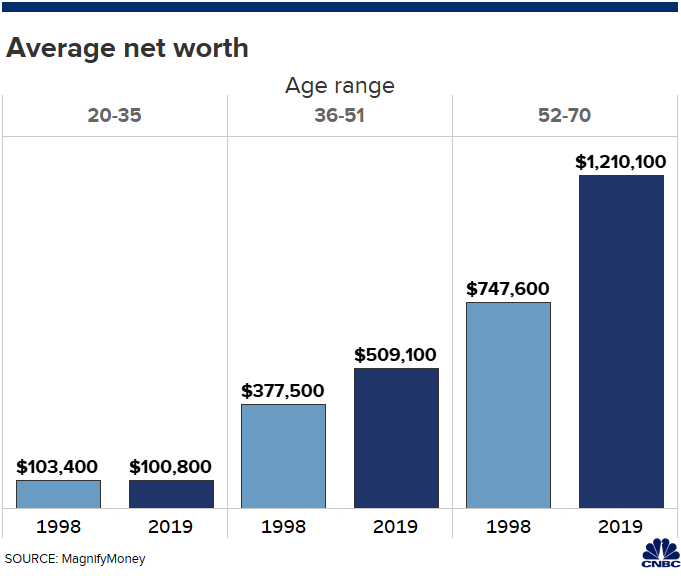

Back in 1998, the average household aged 52 to 70 years had a net worth of $747,600, while households in the 20 to 35 age bracket had an average net worth of $103,400, according to a MagnifyMoney analysis of Federal Reserve data.

Over the last two decades, the oldest cohort has seen their average net worth grow to $1.2 million.

Meanwhile, the 20- to 35-year-olds have an average net worth of $100,800.

“The young adults of 20 years ago were in a much different place,” said Mandi Woodruff, executive editor at MagnifyMoney.

Wealth disparity

Save, save, save, because over the next 30 to 40 years, that is going to help you achieve the financial security that you desire.

Paula Mogan

Senior Vice President, UBS

In addition to these rising costs, the Great Recession also caused millennials to be timid about entering the market, Woodruff said.

“If you watched your parents’ nest eggs, their 401(k)s get depleted, you might respond to that by saying a 401(k) is not a safe vehicle,” Woodruff said. “There’s this fear around getting into investing.

“There’s a fear around opening a 401(k).”

Millennials shouldn’t let market anxiety deter them from investing. After all, they have the greatest asset on their side: time.

“Save, save, save, because over the next 30 to 40 years, that is going to help you achieve the financial security that you desire,” said Paula Mogan, a certified financial planner and senior vice president at global investment bank UBS.

Whip your finances into shape

Pay off high-interest debt. Credit card debt often has high interest rates, which makes it costly to maintain. Refinancing a mortgage at a lower rate might make sense, in some cases.

Set up an emergency fund. Have enough money to cover six months’ worth of expenses. Set up an automatic transfer from your checking to your savings so you don’t have to think about making that small sacrifice each month.

Take advantage of benefits. When you get your first job, put 10% to 15% of your paycheck into a 401(k) plan, especially if your company will match the contribution.

More from Personal Finance:

1 in 3 consumers fear they will max out a credit card

How much money do you need to retire? Try $1.7 million

Student loan payment help is popular job perk but hard to find

Some employers include student debt assistance as an employee benefit, so ask about it, said Mogan.

Budget for your goals. Write down your goals — such as buying a home, getting married, having children — and categorize them into short-term, intermediate or long-term, said Mogan. Then budget for them.

“For example, if a young couple is getting married, buying a home might be a five-year goal,” she said. “Set up a separate account for that specific goal.”