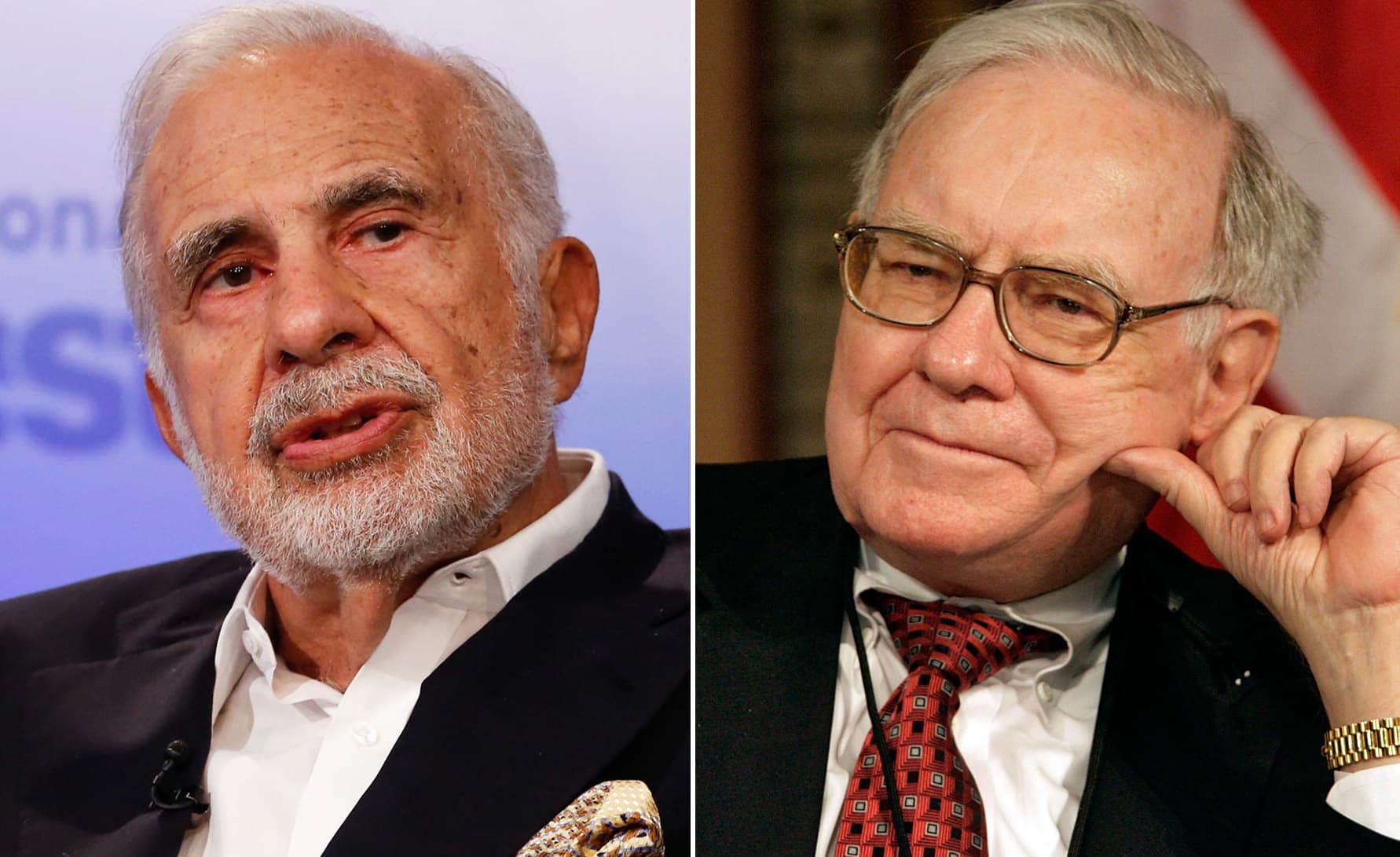

Billionaires Carl Icahn and Warren Buffett.

Getty Images (l) | CNBC (r)

Activist investor Carl Icahn thinks Occidental Petroleum CEO Vicki Hollub got played by the Oracle of Omaha himself, Warren Buffett, in the company’s effort to buy Anadarko Petroleum.

“Buffett figuratively took her to the cleaners,” Icahn said in a letter to shareholders Monday. “The Buffett deal was like taking candy from a baby and amazingly she even thanked him publicly for it!”

“But you can’t blame Warren, if Hollub was arrogant enough to negotiate a deal with Buffett of this magnitude despite her admittedly limited experience in M&A and the Board was misguided enough to rubber stamp it, then one might say in Warren’s defense that it was almost his fiduciary duty to Berkshire Hathaway to accept it,” Icahn added.

Occidental agreed earlier this year to buy Anadarko for $38 billion, a deal which includes $10 billion in financing from Buffett’s Berkshire Hathaway. As part of the deal, Buffett would receive 100,000 shares of cumulative perpetual preferred stock with a value of $100,000 per share. That stock would accrue an annual dividend of 8%. Berkshire would also get a warrant to buy up to 80 million Occidental shares at $62.50 per share a 15% discount from Friday’s close of $73.38.

Icahn blasted the deal after it was announced, criticizing the lack of shareholder input in what he considers an overly expensive acquisition that could put the company in danger if oil prices dropped. Since then, Icahn has launched a proxy fight in which he’s aiming to replace four Occidental directors. Icahn owns 4.4% of Occidental’s shares outstanding.

Hollub said in a letter to shareholders on Monday that “none” of Icahn’s nominees to the board “possess skills, experience or expertise that are additive or superior to our existing directors,” adding: “Mr. Icahn’s own statements demonstrate that he does not understand or support the strategic and financial merits of the acquisition and we believe that his Board nominees would interfere with our ability to successfully integrate Anadarko’s valuable assets.”

Occidental shares were down slightly on Monday. Anadarko’s stock traded marginally higher.