Netflix Co-founder, Chairman & CEO Reed Hastings attends Q&A during Transatlantic Forum as part of Series Mania Lille Hauts de France festival on May 3, 2018 in Lille, France.

Sylvain Lefevre | Getty Images

Netflix shares may be getting hammered on Thursday but research from Bespoke Investment Group shows that history is typically kind to traders who buy at open following a gap lower on poor earnings.

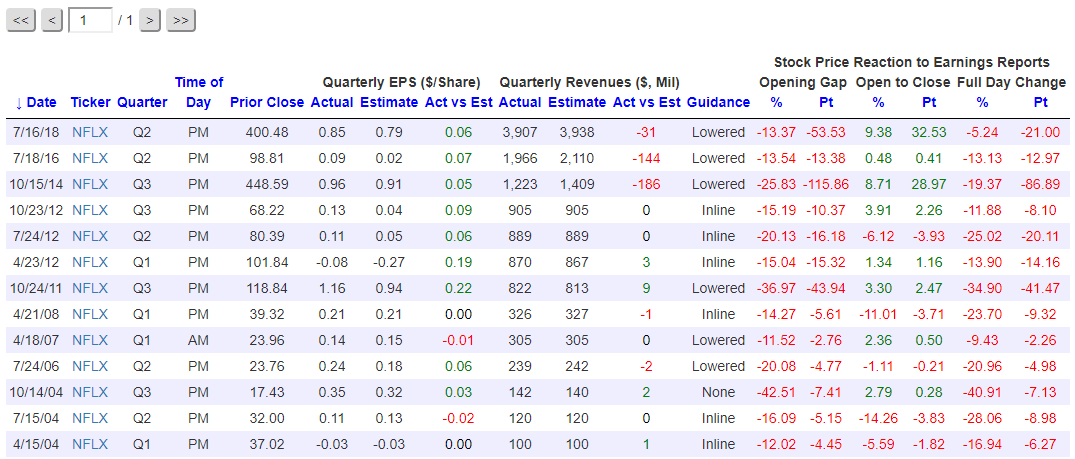

There are 13 days when Netflix shares dropped more than 10% on earnings, Bespoke noted, out of 68 quarters. The “stock rose from the open to the close 8 of 13 times, and each of the last 4 times it has happened,” Bespoke said in a tweet.

Source: Bespoke Investment Group

Netflix dropped nearly 11% in premarket trading from its previous close of $362.44 a share. Despite a big miss in key subscriber metrics, the majority of Wall Street firms continue to recommend buying Netflix shares, with one firm calling this “the Q2 curse.”