Traders work the floor of the NYSE.

Brendan McDermid | Reuters

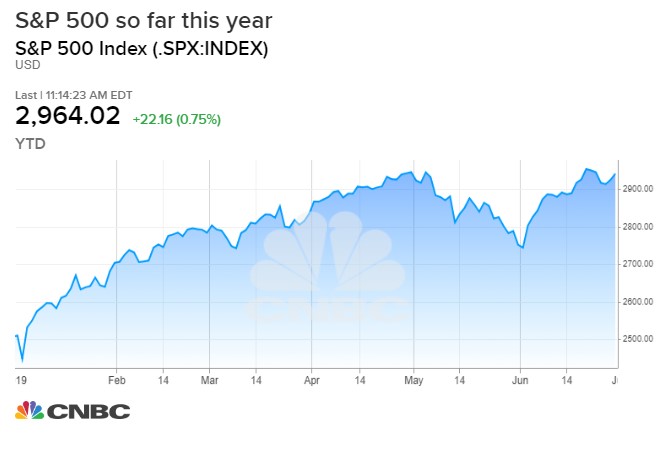

The bull market celebrated its 10-year anniversary with one of its strongest first halves on record, but the second half of 2019 could present some turbulence for the market.

The S&P 500 rose more than 17% in the first half, making this the best first half for the index since 1997, but the outlook for the next six months lacks clarity. The continuing trade war between the United States and China, uncertainty around the Federal Reserves’s rate policies and the expectation of weakening earnings could combine to create a bumpy ride.

A note from Barclays last month said that a substantial increase in the second half would require a significant trade war deescalation, a rate cut and a continued softness of the industrial slowdown.

With all the uncertainty, Brian Belski of BMO Capital Markets wrote that the second half “will be a grind higher rather than a straight shot.”

The first big reveal for the second half came over the weekend, as the US and China called a truce in the trade war. Business groups offered tempered praise of the announcement, and the market opened slightly higher on Monday. However, the lack of a true deal still leaves the future of the trade war uncertain. Morgan Stanley chief economist Chetan Ahya said in a note to investors that, “the developments over the weekend on their own don’t do enough to remove the uncertainty created by trade tensions, which began over a year ago and remain an overhang on corporate confidence and the macro outlook.”

With the trade issue still unsettled, the economic outlook of many investors is trending toward bearish.

Estimates for 2019 global earnings fell 0.9% in June, according to Deutsche Bank. According to Bank of America’s Fund Manager Survey, a net 50% expect global growth to weaken over the next 12 months.

RBC trimmed its EPS forecast for 2019 but said it sees strong buyback activity that could buoy the market.The uncertainty of earnings could lead to volatility, according to RBC.

“We continue to think that the equity market will zig and zag through year end, and that the risk in the short-term is to the downside,” the RBC analysts wrote.

Will Fed save the day?

Despite concerns of a weakening economy, the Fed kept investors guessing at its June meeting. The median outcome for the year is still no rate cuts, according to the open market committee’s most recent dot plot, but eight voting members prefer at least one cut this year.

“Our view has been that the current equity resilience can be justified by the fact that the monetary stimulus can counteract the negative drivers that have emerged since May,” Barclays analysts wrote. “However, there are now signs that the Fed will remain aggressive irrespective of trade tensions, which is likely to be viewed by equity investors as the Fed erring on the side of being ultra loose.”

That confidence in monetary policy is not widely shared, however. Thirty-two percent of those in Bank of America’s investor survey last month said they expect the Fed to cut rates this year, but managers aren’t sure a cut will be able to sustain the markets. “Monetary policy impotence” was the second most commonly cited tail risk, following only the trade war, in the survey.

As investors look for clues about future developments of these issues, the coming months could see increased volatility.

“We believe higher levels of volatility as well as spikes in volatility could become more common in 2H given the current market environment,” Belski wrote.