Traders work at the Coty booth on the floor of the New York Stock Exchange.

Jin Lee | Bloomberg | Getty Images

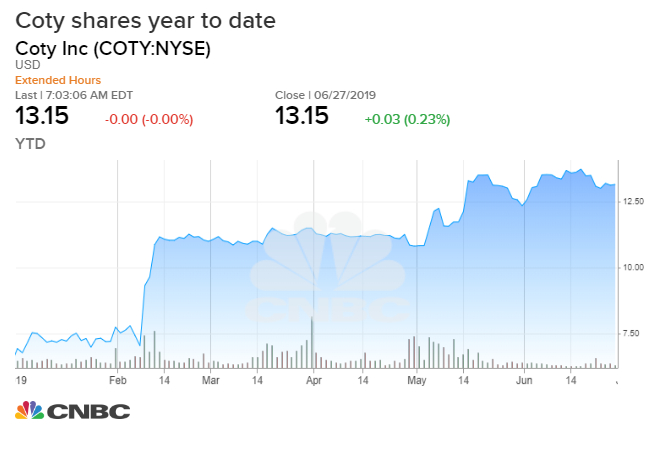

Beauty company Coty is by far the best-performing stock in the S&P 500 so far this year.

Shares of the cosmetics distributor are up more than 100% in 2019, while the S&P 500 is up only 17%. Investors are betting on a major turnaround for Coty, under new management and finally recovering from its acquisition of P&G’s beauty business. The stock fell 67% last year.

Coty, which distributes cosmetic brands like Opi, Covergirl and Sally Hansen, is in a transition period and many investors see its “steeply discounted” stock, trading around $13 a share, as an opportunity, said Jonathan Feeney, analyst with Consumer Edge Research.

Feeney attributes Coty’s success to its “well regarded and now controlling owner,” JAB Holdings. Private equity firm JAB, which also controls Dr. Pepper among others, took control of Coty in April, a move well respected by analysts on the Street.

“While worse than expected, U.S. mass beauty trends caught management by surprise — management is making the necessary pivots,” Feeney said.

JAB has the company braced for change. The firm brought in Coty’s new CEO Pierre Laubies, who will unveil his turnaround strategy for Coty on July 1.

Kardashian boost?

JAB is also not shying away from M&A deals to fill portfolio gaps. Earlier this month Women’s Wear Daily reported that Coty is in talks to take control of Kylie Jenner’s $1.2 billion cosmetic company Kylie Cosmetics.

“Coty can’t really afford to be making sizable acquisitions at the moment, albeit we do think JAB would find a way to get creative for the right asset,” Barclays said in a note to clients.

However, analysts agree that Coty’s core brands — like Covergirl, Rimmel and Max factor — are losing momentum. In a recent note, D.A. Davidson said that four of Coty’s six “color cosmetic brands” have lost social media ranking. D.A. Davidson has a neutral rating on the stock.

Coty has a “disjointed portfolio of largely disadvantaged brands that lack global and even local scale,” Barclay’s Lauren Lieberman said in a note to clients. Barclays has a hold rating on the stock.

Picking up P&G’s pieces

In 2016, Coty announced it was going to acquire P&G’s beauty business. After a volatile 2017 and 2018 integrating the acquisition, the company is at an inflection point, according to RBC Capital Markets, which is one of two firms with a buy rating on the stock.

RBC expects top line margins to “improve and expand on the back of productivity efforts and synergies from the P&G acquisition” starting in 2022.

“This thing is rebounding after getting absolutely pummeled in the second half of last year when they announced their plans to buy P&G’s beauty business,” Mark Tepper, RBC’s president of strategic wealth management, told CNBC’s “Trading Nation” last month.

Tepper said Coty’s fundamentals also don’t support a long-term breakout.

“Their overall strategy, in my opinion, is still flawed,” Tepper said. “With their acquisition from P&G, they’ve basically doubled down on mass consumer, but consumer buying trends have changed. Consumers now want experience, they want prestige, they want boutique, not CoverGirl. And [Coty’s] debt levels are sky high.”

Part of the run this year could be due to a “short squeeze” as lots of investors have been betting against the stock. Coty is one of the most shorted stocks in the S&P with 14.6% of its float sold short, according to FactSet. But it has a small float, at just 37%.

Beauty stocks are all getting a boost this year with shares of Ulta and Estee Lauder both up more than 40% since the start of the year and e.l.f Beauty rocketing more than 60% in 2019.

— with reporting from CNBC’s Michael Bloom.