Slocan Lake, BC

Ira T. Nicolai | Stone | Getty Images

It’s not every day that you’d tell a retiring client to ratchet up their stock exposure, but if she has some guaranteed income, it just might make sense.

That’s because pension income, Social Security benefits and income annuities all provide retirees with a measure of safety, said Michael Finke, professor of wealth management at The American College.

“If you have a safety net, the consequences of risk aren’t as severe for you,” he said, speaking at the American Institute of CPAs Engage conference in Las Vegas.

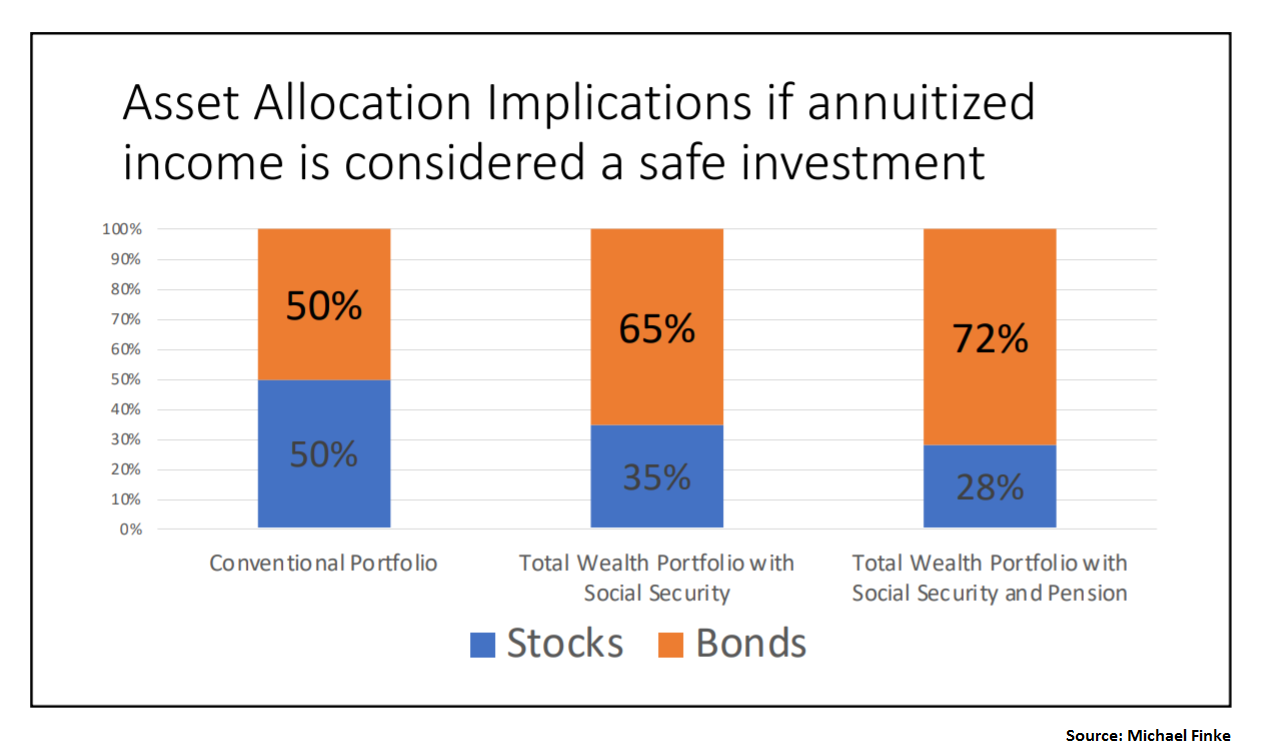

“If you have significant guaranteed income, your portfolio is more skewed toward safety,” Finke said.

That means these pre-retirees can afford to take additional risk in the form of higher allocation toward stocks.

Three portfolios

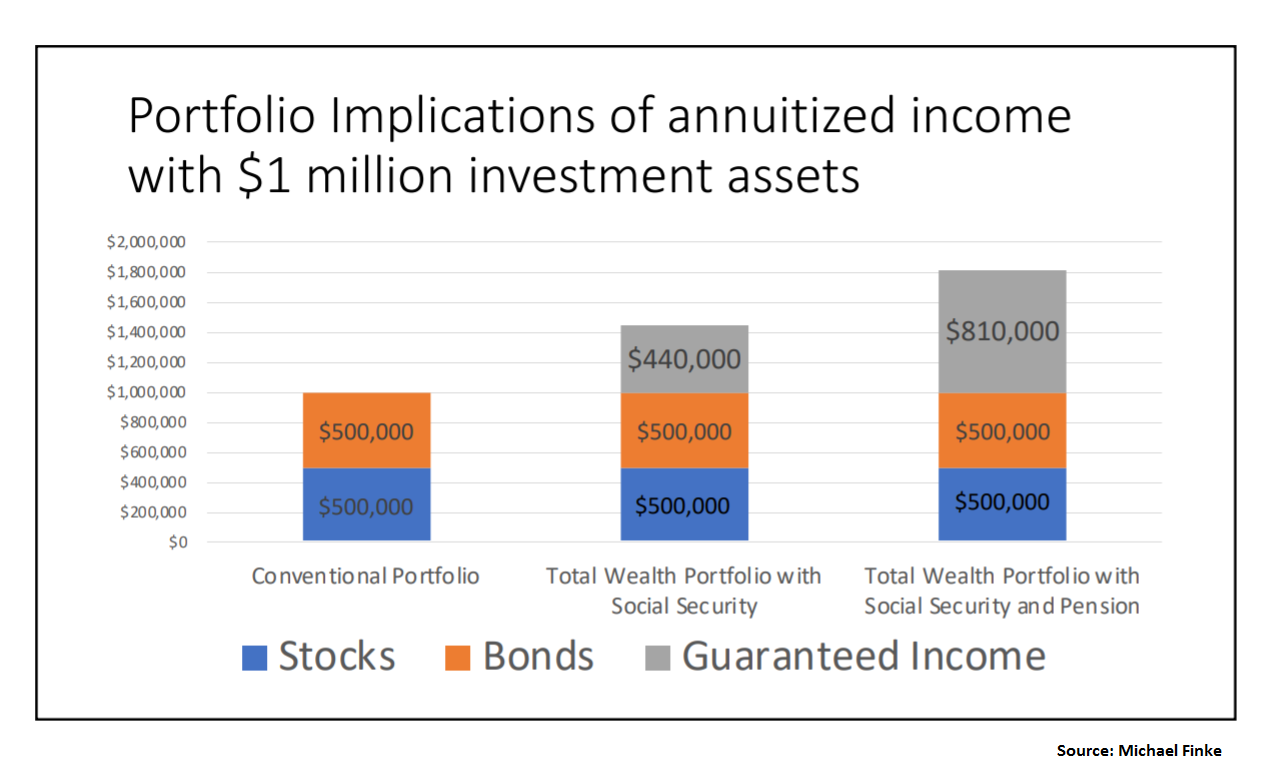

Finke modeled out three hypothetical investors, each with $1 million saved.

Client A has only her $1 million portfolio. Meanwhile, Client B has the $1 million portfolio, plus a $20,000 income stream from her Social Security withdrawal benefits.

Finally, Client C has $1 million in her portfolio, a $20,000 annual income stream from Social Security, and $30,000 annually from her pension.

Instead of viewing the investible assets and the Social Security income and pension as separate components, advisors should see them as part of one overall portfolio for the client.

That would mean estimating the portfolio value of the guaranteed income stream, be it Social Security or the pension, said Finke.

Since the investor can count on receiving these sources of income each year, it makes them comparable to the fixed income portion of the client’s holdings.

As a result, Client C, who has both a pension and Social Security, really has 72% of her wealth in bond-like investments, Finke said.

Ratcheting up risk

Klaus Vedfelt | Getty Images

An investor with guaranteed income sources can take greater risk and add to her stock exposure.

“Guaranteed income is going to be smooth every year, so the consequences of investment volatility aren’t as great,” Finke said.

For instance, an investor with $1 million in assets and a moderate risk tolerance might invest 35% of that amount in stocks and 65% in bonds, he said.

However, if she instead earmarked 20% of that $1 million toward an income annuity, she could increase her stock exposure to 40% of her investible assets and allocate the remaining 40% toward bonds, Finke found.

Weekly advice on managing your money

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.

He estimated that a single premium immediate annuity that produces $20,000 in income for a 65-year-old female would cost about $326,289.

Creating that stream of guaranteed income means that retirees can also avoid spending down their invested assets too quickly.

More from FA Playbook:

5 tips for advisors to consider before the stretch IRA dies out

Advisors must way benefits and risks of this hot new tax play

College programs look to fill the advisor talent gap

For instance, a client has $1 million in an investment portfolio and a spending goal of $40,000.

This client stretches her nest egg if she uses some of the portfolio to buy an annuity that pays $20,000 a year. This way she only withdraws $20,000 from her investments to meet her spending needs – instead of the $40,000.

“You take the pressure off the rest of the portfolio and withdraw from it at a lower rate,” said Finke. “That’s why we end up with better outcomes over time.”