In this May 2, 2019, file photo Beyond Meat CEO Ethan Brown, center, watches as his company’s stock begins to trade following its IPO at Nasdaq in New York.

Mark Lennihan | AP

Short-sellers lost $398 million betting against Beyond Meat through Friday, according to research S3 Partners. And those losses got bigger on Monday as the stock surged yet again.

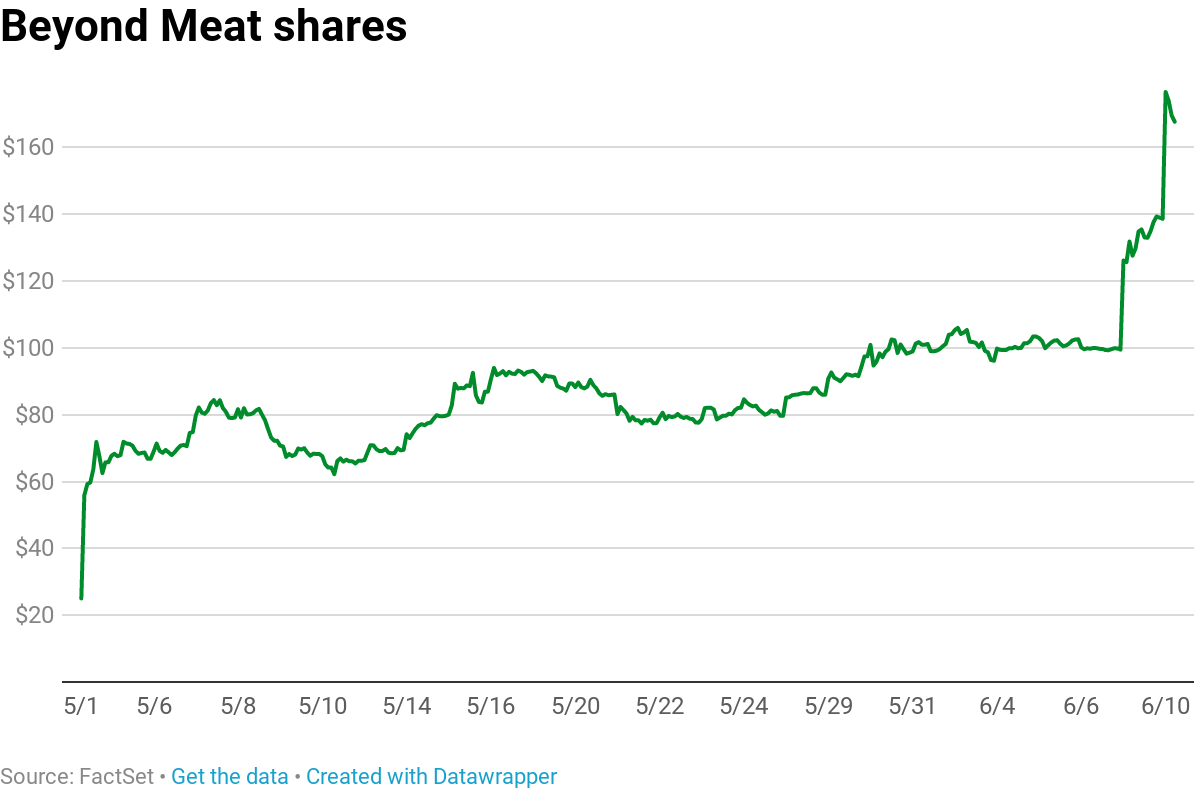

The shares jumped 22% on Monday, following a 39% surge on Friday. The stock is up almost 600% from its IPO price of $25 per share in early May.

Short sellers including Citron Research’s Andrew Left scrambled to cover bets against the alternative meat company. Covering a short entails buying the company’s stock to prevent further losses. When that happens en masse it can cause a phenomenon known on Wall Street as a short squeeze. Squeezes can be exacerbated when a the number of floating shares is small, which is the case with Beyond Meat

Left told CNBC on Monday that he covered his short on the stock at $90 as it rallied, protecting him from further loss. The stock was last trading at around $169.

Left had said on May 17 when the stock was trading between $85 and $90 that the hype around the plant-based meat substitute company had sent its stock too high.

Beyond Meat “has become Beyond Stupid,” Citron Research said on May 17, before he covered. “Most heavily traded retail stock on Robinhood, market cap now bigger than industry, and superior competitor coming to market soon.”

Though Left predicted that the stock would eventually fall to $65, Beyond topped analyst expectations last Thursday, when it reported its first financial results as a public company.

“I know a short set up when I see one,” Left said in an email to CNBC on Monday. It’s a good product but with a “ridiculous valuation considering it is the food business. But you have to respect share structure.” Left is referring to the small float, or shares available for trading or shorting, in Beyond Meat.

The stock is by far the most successful initial public offering of 2019. The company, which aims to create “the future of protein,” has developed plant-based burgers, sausage and other alternatives for those interested in moving away from meat-heavy diets.

Beyond Meat isn’t the only food company looking to take market share from mature food companies. Impossible Foods, which has yet to trade on the public market, is taking aim at the restaurant space and food giants like Tyson Foods and Nestle.