Bukharova | Getty Images

One Wall Street strategist is warning that three factors could trigger the stock market’s next sell-off before the end of May and push the major indexes to lows as the summer season gets under way.

The combination of mounting recession fears, bets on a more cautious Federal Reserve and a regular uptick in market volatility at the end of May may be too much for equity investors to withstand, wrote Nomura strategist Masanari Takada.

“Investors should be focused on the potential downside for global equities in the near term, given that sentiment is still pointing down,” Takada wrote in a note to clients. “We think a second wave in the selloff may still be coming, and with risk-parity funds due to rebalance their portfolios at the end of the month as well (presumably selling stocks and buying bonds), we think it best to be on guard for a jump” in volatility next week.

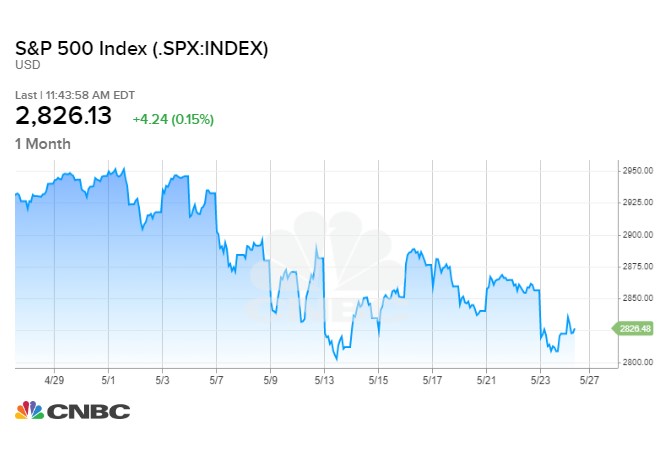

First, short-term market players like macro hedge funds have started selling U.S. equities and buying bonds, encouraging others to follow suit with similar “pessimistic” moves, the strategist added. Some traders also viewed the S&P 500’s intraday drop below 2,820 on Thursday as a technical indicator to cut losses.

Stocks have been under pressure in recent days, weighed down mounting concerns that the trade war between the U.S. and China could persist longer and curb GDP growth more than first thought. Investors have pointed to trade angst for a 1% decline in the Dow Jones Industrial Average and a 1.3% fall in the S&P 500 this week.

Investors may been less inclined to buy equities following the release of the Federal Reserve’s latest meeting minutes, Normura said. While investors still believe the central bank is more likely than not to cut rates at least once by December, its more upbeat tone in May may change those odds. Some market participants believe that Chair Jerome Powell and his colleagues won’t let the financial markets deteriorate too much before slashing rates in an attempt to soften the fall.

“This change in tone may shake the confidence of certain fundamentals investors who have been expecting an exercise of the ‘Fed put’ but, at the same time, the market may be moving in anticipation of bad news in a way that ultimately forces the Fed to execute a precautionary rate cut anyway,” Takada wrote.

Lastly, the strategist warned that a second-wave surge in volatility could still creep on traders before the month’s end. Based on historical trends, volatility derivatives tend to spike twice in May, portending a potential surge in angst over the next five trading sessions, according to Nomura.