An analyst for a firm with a major investment in Tesla said Friday that recent drastic price-target cuts on the stock by others on Wall Street are missing the big picture.

Ark Invest, whose founder predicted on CNBC last year that Tesla could hit $4,000 per share, stands by that call, even as the stock has lost about 40% of its value in 2019.

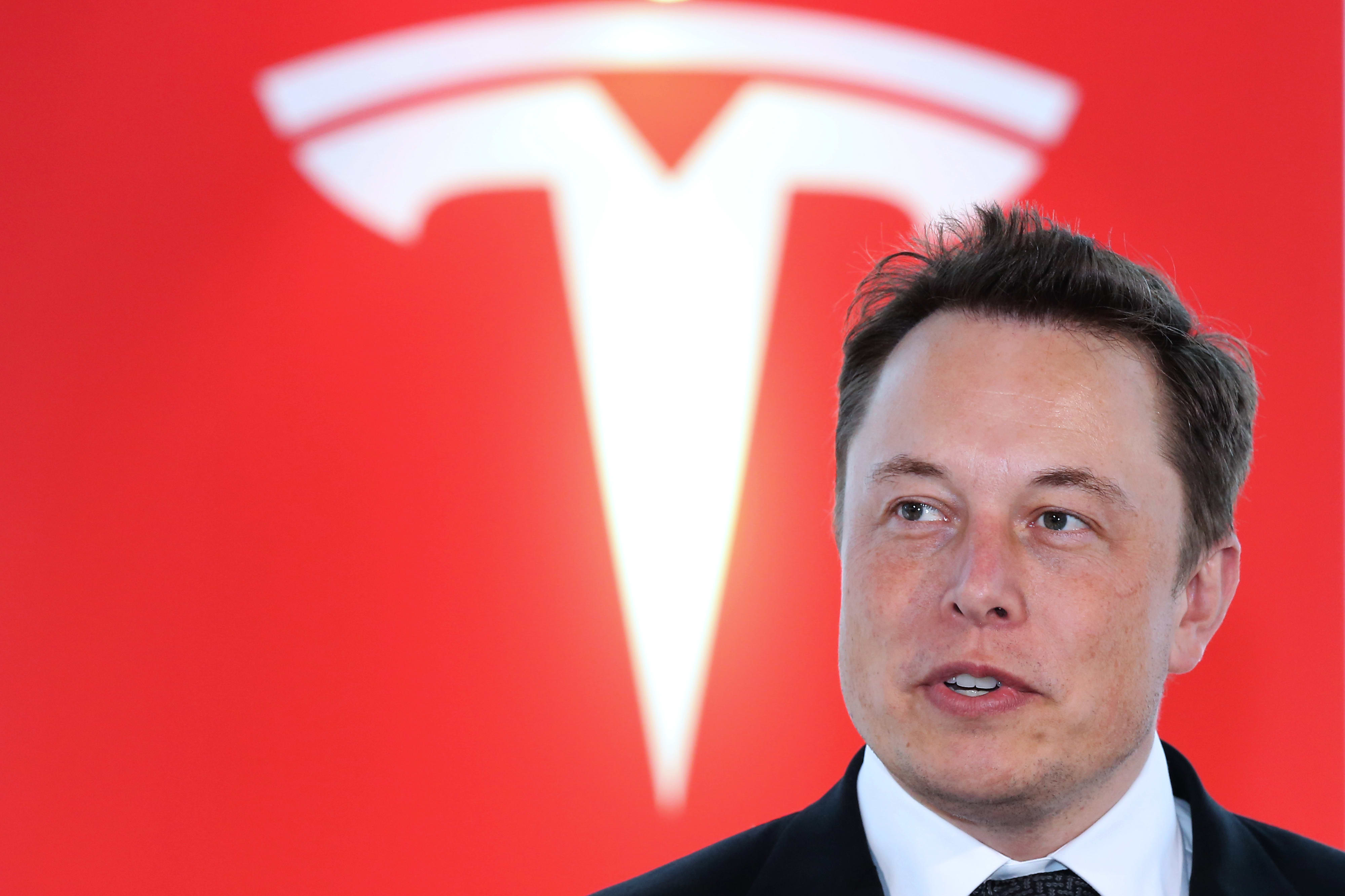

Tasha Keeney, an Ark analyst, said in an interview on CNBC’s “Squawk Box” that Wall Street is “misunderstanding the Tesla story” and the potential upside of Elon Musk‘s vision. Musk’s accomplishments are widely acknowledged, but he’s gotten himself and Tesla into trouble with the government over his comments, stemming from an August tweet about possibly taking the company private with “funding secured.”

Keeney said Ark believes so strongly in Tesla that its five-year, bear-case scenario is $560 per share, which would be nearly triple the value of where the stock closed Thursday at $195.

This week, Morgan Stanley put a worst-case of $10 per share on Tesla. A day later, Citigroup said the stock could fall to $36 per share.

Tesla has always been a battleground stock as one of the most loved and hated. Tesla is also one of the most shorted stocks. Shorting a stock is a bet that it will go down.

The electric vehicle maker began the month saying it would raise more than $2 billion through stock and convertible debt. The company’s cash burn and need to repeatedly raise money has been a concern among its detractors.

Keeney, however, said Ark is not troubled by additional fundraising. “If we talk about cash, and those worries, in our valuation model we actually expect, we have Tesla raising an additional $10 billion to $20 billion in the next five years. And we’re actually OK with that.”

“We want them to get as many cars on the road as possible” with the next step of running a “fully autonomous taxi network.” Last month, Musk promised 1 million vehicles on the road next year that are able to function as “robo-taxis,” a claim that was generally thought to be optimistic, at best.

On an investor call earlier this month, two of the invitees told CNBC that Musk predicted autonomous driving will transform Tesla into a company with a $500 billion stock market value. As of Thursday’s close, Tesla’s market cap was just over $34 billion.

Keeney admits that Musk sets “extremely aggressive goals” and often falls short. “But in doing that, in sort of pushing to that target, they’ve been able to achieve the impossible so far.”

She also countered the argument that demand for Tesla vehicles is waning. “Sixty-nine percent of the trade-ins for the Model 3, for the standard range version, were non-premium vehicles. So they are pulling in demand from other segments. They outsold their next best competitor by 60% in the premium vehicle segment.”

“People clearly like these cars for a good reason. Tesla has a software advantage that no one else can beat,” she added.

CNBC’s before the bell news roundup

SIGN UP NOW

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.