Investors will learn more Wednesday about why Federal Reserve officials did an apparent U-turn in policy three weeks ago when they signaled a much easier stance regarding interest rates.

Minutes from the January 29-30 meeting of the policymaking Federal Open Market Committee will be released at 2 pm. At the meeting, the committee voted not to increase its benchmark interest rate, but signaled a “patient” approach to future hikes. Fed Chairman Jerome Powell said afterward that it would take a shift in data to convince him that more moves would be needed.

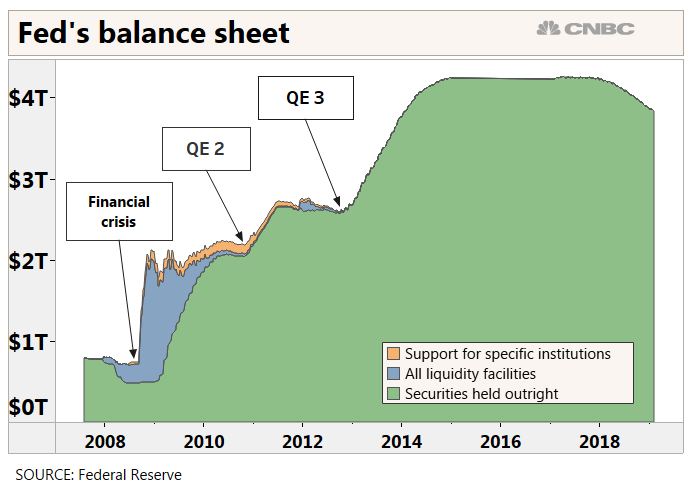

Market participants will be digging closely through the meeting summary for clues on how the Fed views its interest rate framework, the assessment on the economy, and the plans it has for the $3.8 trillion in bonds it is holding on its balance sheet.

While a minutes release might seem an otherwise mundane dig through monetary policy, the Powell Fed has put a special emphasis on communication. The chairman now will hold news conferences after each meeting to explain Fed actions to the public, and he has kept up a busy schedule meeting with lawmakers on Capitol Hill.

“More communication is better,” Bill English, a 20-year Fed veteran and current professor at the Yale School of Management, said in an interview. “Things can be misunderstood and communication can go badly, but the response to that should be more communication and trying to clarify, and not communicating less. The world of a generation ago when the Fed didn’t communicate much about monetary policy at all isn’t actually a very desirable world for doing monetary policy.”

Fed officials have been pretty clear lately about their intentions on interest rates. Less certain is what the central bank will do with the balance sheet.

The Fed currently allows up to $50 billion a month in proceeds from Treasurys and mortgage-backed securities to roll off, though it does not regularly hit that number. Anything beyond that would be reinvested.

Since the process began the bond portfolio has shrunk by more than $400 billion. The balance sheet had once stood at $4.5 trillion, the product of three rounds of bond buying — quantitative easing — the Fed instituted to lower long-term rates and pull the economy out of the financial crisis.

Market participants are now wondering how much further the Fed will go. The minutes will be looked at closely, particularly considering that the stock market rallied after the meeting and the perception that the Fed would take a less aggressive approach to tightening.

“The minutes from the two preceding meetings – November and December – included important sections on the balance sheet,” Lewis Alexander, chief economist at Nomura, said in a note. “We believe the corresponding section of the January minutes will confirm the Committee’s plans to end balance sheet normalization by end-2019.”

Several Fed officials have pointed to the end of the year as a likely point for the process to end, but even that remains in flux.

The key in the discussions thus far is the level of reserves at which the banking industry feels comfortable. The decline in the balance sheet corresponds with a lower level of reserves. Currently, banks are holding about $1.64 trillion in reserves, or nearly $1.5 trillion above the required level.

Many Fed watchers think the final level will be somewhere just in excess of $1 trillion, though some see it higher.

“Once we reach $1.1 [trillion] of reserves, the normalization is done,” wrote Jabaz Mathai, head of U.S. rates strategy at Citigroup.

Markets have expressed concern that the balance sheet rundown is working in tandem with rate hikes to tighten financial conditions. While Fed officials have insisted that the roll-off will happen with minimal market disruptions, the feeling on Wall Street is otherwise.

“As growth risks pile up externally and internally, the Fed will want to make sure that [quantitative tightening] is not a constraint that weighs down on financial conditions and hence on the economy,” Mathai said. “Our view is that the effects of QE (and by extension QT, and the end of QT) work through the signaling channel. The Fed signaling that QT is ending, is a Fed signaling readiness to cut rates at some not too distant point in the future.”

Indeed, the market sees no additional rate hikes ahead as the Fed’s benchmark rate sits in a range between 2.25 percent and 2.5 percent. Traders actually are assigning a small chance — about 10 percent — to a rate cut by December.

Another related issue that could come up in the minutes is how Fed officials convey their intentions to the public.

Powell suffered a series of missteps that began in October when he said the Fed was “a long way” from a neutral rate, and then again in December when he described the balance sheet operation as being on “autopilot.”

Markets have recovered mostly from those issues, but Fed officials have been discussing how to improve communications, particularly if another crisis hits.

English said officials have some other options available to them to give the public a more reliable road map for future intentions.

Among them are a “fan chart” for the possible directions of the fed funds rate, and information about the way policy could respond to changing economic conditions.

The fan chart would be similar to one the committee uses to know display the level of uncertainty around interest rate projections. The intent is to keep investors aware of how much difference there is in various forecasts and reinforce that the rate estimates are not carved in stone.

“One way or another it is just to suggest that while there is this path for the fed funds rate and the summary of economic projections, there’s a great deal of uncertainty around that path and the committee will adjust that path accordingly under changing circumstances,” English said. “That’s the point you’re trying to make.”

English said the current discussions around future policy responses could end up with a friendlier view toward negative nominal interest rates, as a recent Fed paper discussed, and quicker action to institute programs like QE.