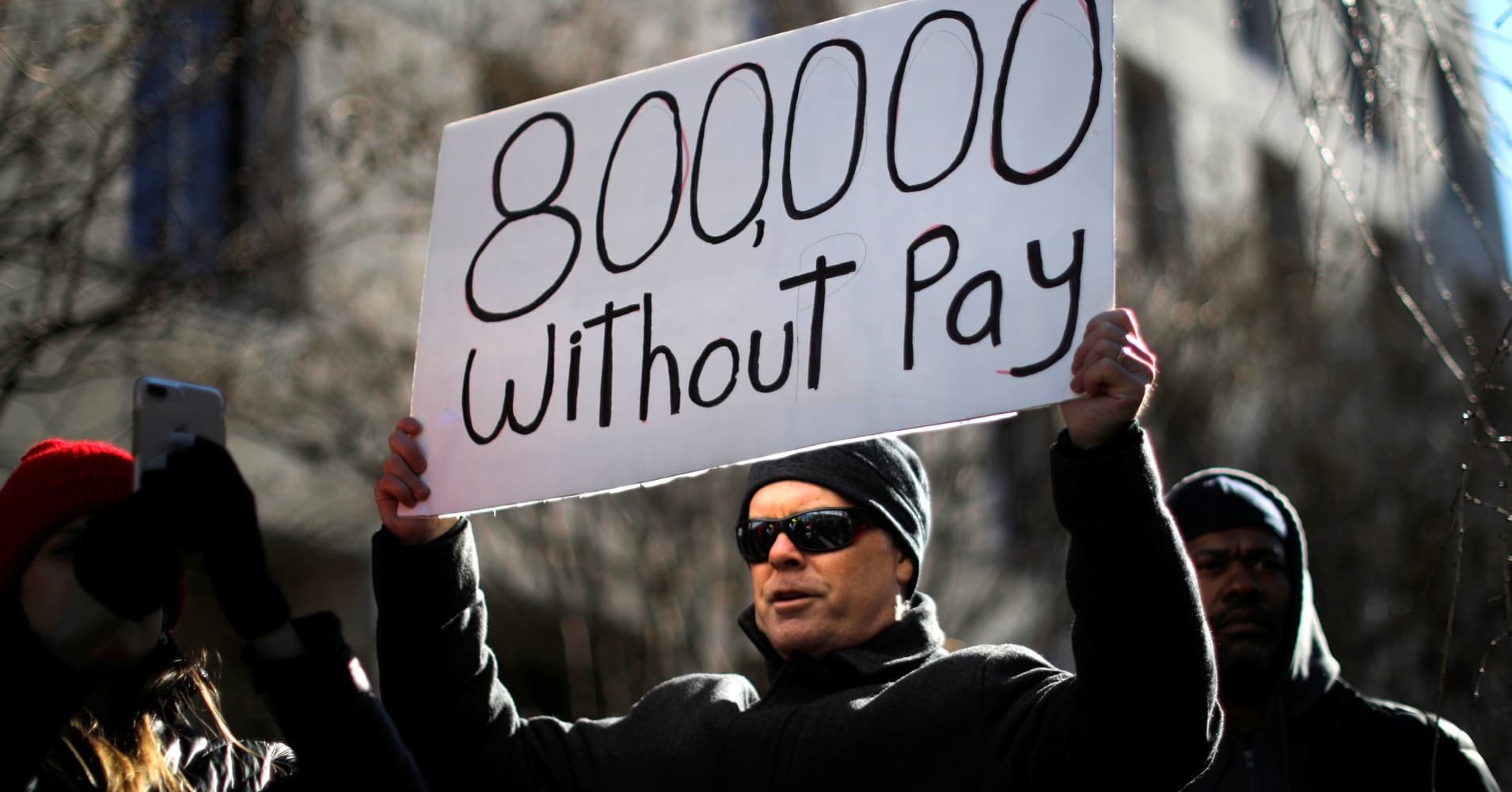

Three weeks into a partial government shutdown, hundreds of thousands of federal workers are furloughed or working without pay.

That’s longer than most can get by without income, considering that over three-quarters of all full-time workers are living paycheck to paycheck, according to a report from CareerBuilder.

Federal workers are particularly vulnerable. On average, government employees take home roughly $500 a week, according to the American Federation of Government Employees, a labor union representing about 700,000 workers.

For them, any interruption in pay could a have devastating impact on themselves and their families.

When it comes to weathering a financial hardship, financial experts say the secret to success comes down to two tools: budgeting and borrowing.

Start by writing down your expenses, said James Sullivan, a vice president and financial advisor at Essex Financial in Connecticut. “You need to see where the funds are going.”

Then, identify any items that you don’t really need for now, or nonessential expenses, he advised, which will be different for everyone. “If you’re financially at risk, decide the right fit for you to get through this temporary setback.”

Apps such as Mint or Albert keep can help by keeping tabs on your spending and finding places where some expenses can be cut. These budget tricks will also help you make the most of the money you have.

Next, look at your fixed expenses and determine how they can be temporarily suspended or eliminated. Monthly recurring expenditures such as gym memberships, lawn care and cable are often great opportunities to cut costs to reinstate your cash flow.

Some fixes may require a more severe sacrifice, Sullivan cautioned. “It could mean taking a step back on paying for college,” he said.

For furloughed federal workers, there are also a number of ways to access cash to bridge the gap.

For starters, “consider tapping into your savings account or borrowing from a friend or family member,” said Ashley Dull, a credit strategist at CardRates.com.

However, if you do borrow money from friends or family, “write down the terms of the loan including if there will be interest and when you will pay it back,” Sullivan said.

Another good option is to see if your lender is offering relief. Credit unions and banks across the country are stepping up to help federal employees and families affected by the government shutdown.

And many of those financial institutions are working with affected individuals to waive fees and adjust payment dates on mortgages, credit cards and other obligations on a case-by-case basis, noted Ted Rossman, an industry analyst at CreditCards.com.

So, if you need assistance, reach out right away, he said. “Anyone affected by the partial government shutdown who is having trouble paying a bill should call their creditor ASAP.”

“Of course, there’s no such thing as a free lunch,” Rossman added. “Even if your lender is willing to adjust your payment date, you may still be charged interest even though they say you don’t need to send in this month’s credit card payment.”

There are also other drawbacks to any kind of loan — including tapping your home equity or retirement account or relying on a credit card — when you are low on cash. But some are worse than others.

Other sources include personal loans and credit card advances; click here for the best and worst ways to borrow money.

More from Personal Finance:

To protect economy, financial regulators urge lenders to work with borrowers during record shutdown

These budget tricks will help you make the most of the money you have

With no end in sight for the shutdown, thousands of federal workers file for unemployment