Call it the Apple turnover.

Shares of the tech giant are down over 30 percent from its October high, shedding more than $400 billion in market capitalization from peak to trough.

Apple‘s collapse comes amid growing fears over iPhone demand and trade tensions. Last week, the stock fell nearly 10 percent in a day, setting its worst performance since 2013 after CEO Tim Cook told CNBC that the company could come up short on its quarterly earnings report later this month.

The move not only shocked Apple investors, but it underscored a key theme in the exchange-traded funds (ETF) market: Know what you own.

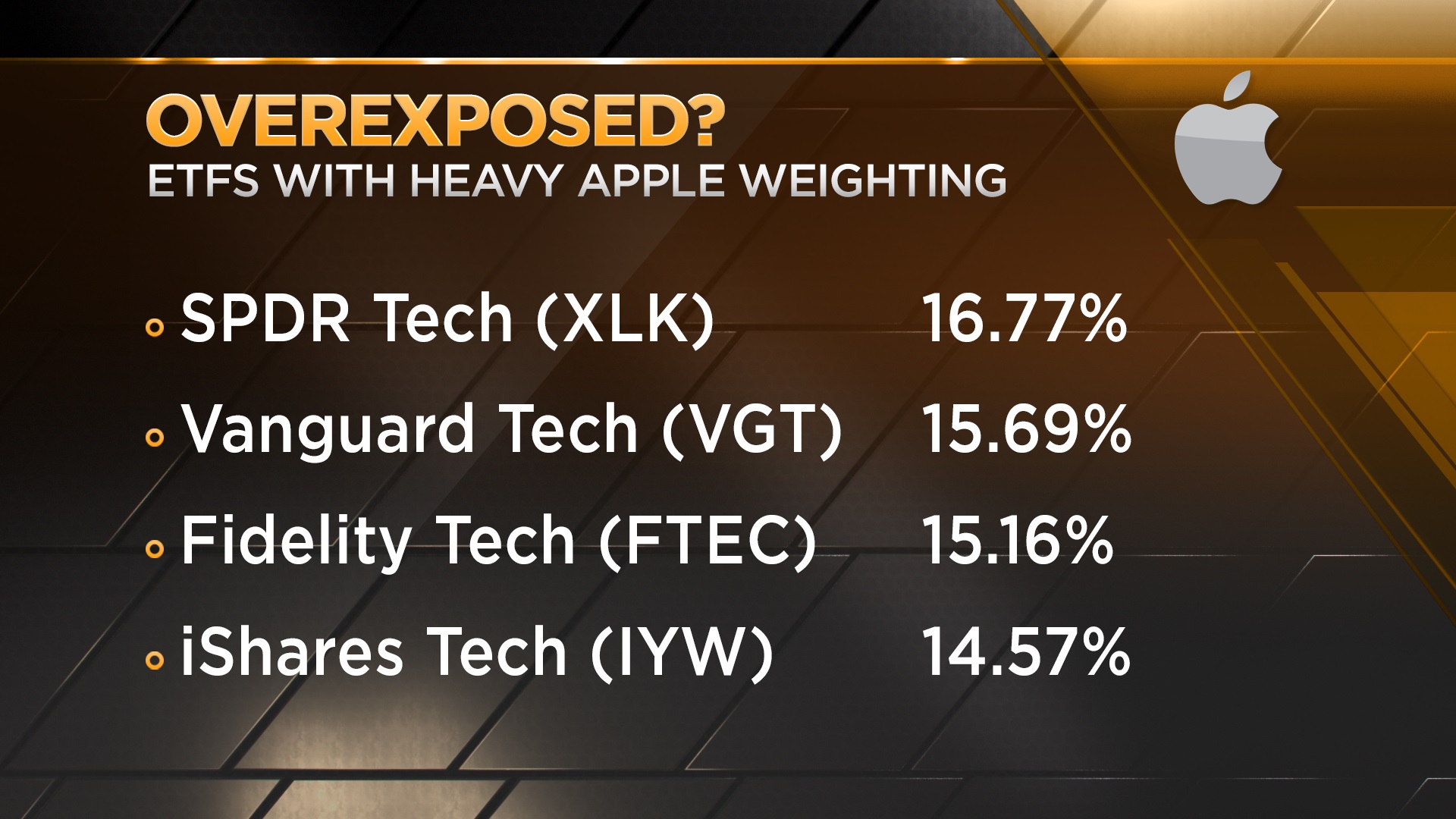

According to ETF.com, nearly 300 million shares of Apple are scattered throughout hundreds of U.S. funds. Among those heavily tied to the stock are the XLK Technology SPDR, the VGT Vanguard Tech ETF and Fidelity’s FTEC MSCI Tech index.

But if you’re tech ETF has been burned by the Apple trade, there are other ways to invest in the tech space.

“The RYT is a clear alternative here,” ETF.com managing director Dave Nadig said in a recent interview with CNBC’s “ETF Edge.”

He added that Apple’s “exposure to each individual name is only about 1.5 percent. That puts your Apple exposure inside of the RYT as half of the exposure you would have just in the S&P 500. Currently Apple is sitting at about 3.5 percent of the S&P.”

In addition to Apple, the RYT holds stocks like Applied Materials, Salesforce, Oracle and Visa.

Doug Yones, head of exchange traded products at the New York Stock Exchange, looked to two actively managed tech ETFs that have been beating the market.

“You have the Ark Innovation ETF, the ARKK, and the Ark Web x.o ETF, the ARKW, both of which are in the technology sector where a portfolio manager is going to choose whether they want to own Apple. It doesn’t have to be an ‘own it all’ because you’ve chosen an ETF,” Yones said Monday.

The ARKK is up more than 3 percent over the last year, while the XLK tech sector ETF is down more than 4 percent.