If the government shutdown lasts another two weeks, the total cost to the U.S. economy would exceed the price of building the proposed border wall.

According to an estimate by S&P Global, it will only take another two weeks to cost the economy more than $6 billion, exceeding the $5.7 billion that President Donald Trump demanded to fund his proposed border wall. The U.S. economy will have lost $3.6 billion dollars by Friday, according to S&P.

“We estimated that this shutdown could shave approximately $1.2 billion off real GDP in the quarter for each week that part of the government is closed. That may seem like pennies for the world’s biggest economy, but it means a lot to those workers trying to cover their household costs without their paychecks,” Beth Ann Bovino, S&P’s chief U.S. economist said in a note on Friday.

The firm came up with these figures by looking at costs related to the shutdown including lost productivity by furloughed workers and a decrease in sales for contractors to the government.

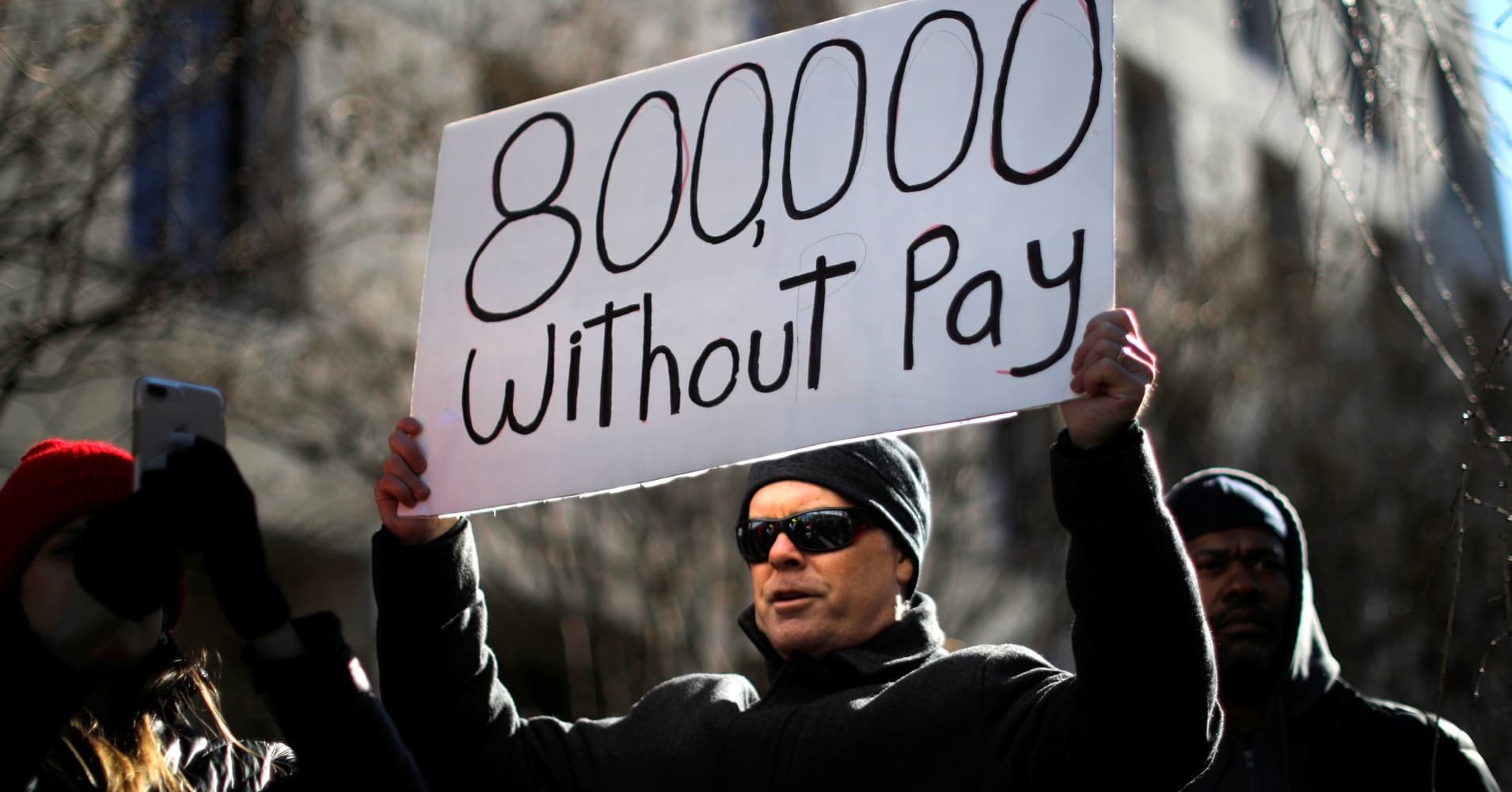

The partial government shutdown entered its 21st day Friday, tying the record for longest lapse in federal funding. Lawmakers have failed to fund about a quarter of the government, as President Donald Trump demands money for his proposed border wall. The president has threatened to veto legislation passed by the Democrat-controlled House to reopen the government temporarily, and that has deterred the GOP-controlled Senate from passing it.

As the government shutdown nears a record-breaking run, retailers like Best Buy and Bed Bath & Beyond could start to feel the bite from lower consumer spending.

With 800,000 federal workers not being paid and a potential delay in tax refunds, the economic effect of the partial government shutdown could be at least $2 billion per week, according to Wells Fargo retail analysts.

The retailers that would be hurt the most include those that sell more discretionary goods such as Best Buy and Bed Bath & Beyond and those operating in regions with high government employment, including Ulta Beauty and Dick’s Sporting Goods, the bank predicted.

Retailers that sell household necessities may have more of a cushion now, but “If the shutdown were to eventually impact benefit programs like SNAP, players like dollar stores, Walmart and Kroger could feel pressure,” Wells Fargo’s Zachary Fadem said in a note to clients on Friday. “On the other hand, history illustrates that prior shutdowns had limited impact on retailers with staples-like characteristics, including grocers and auto part retailers.”

Wells Fargo is not alone on Wall Street seeing the damage from the shutdown hitting retailers. Jefferies took a closer look at the areas with the most workers affected by the shutdown — Washington, DC, Maryland and Virginia. Companies including restaurant chain Chuy’s, and retailers The Container Store and Nordstrom, that have a higher percentage of locations in those areas will likely experience more damage.

“Impact from the government shutdown could extend well beyond some restaurants in DuPont Circle, “Jefferies’ Laurence Alexander said in a note on Tuesday, referencing a section of Washington, DC.

The shutdown in 2013, which lasted 17 days, shaved 0.4 percent off GDP in the fourth quarter of 2013. Alexander pointed out that payments to government contractors are likely to be affected as well as home sales because of delays in federal loans.

J.P. Morgan economists have already cut their first-quarter growth forecast by a quarter point to 2 percent because of the shutdown. Bank of America Merrill Lynch economists shaved 0.1 percentage point from fourth-quarter growth, bringing that forecast to 2.8 percent, due to the shutdown.

If the shutdown gets resolved before the end of the quarter, some of the lost spending may be recovered once the workers get back pay, but GDP inputs like productivity are permanently gone.

“While government workers will likely recoup their lost wages once the government opens, as they have in the past, the many government contract workers who are out of work because of the shutdown are unlikely to get back pay,” stated S&P Global. “Workers who are living paycheck to paycheck will struggle to make ends meet the longer this goes on. As the standoff drags on, no paychecks are arriving to refill their savings, pay down credit card debt, make that mortgage payment, or pay their rent.”

— With reporting by Michael Bloom